In Focus: European Debt Capital Markets

4 Key Themes for 2025

Among the layers of complexity within European debt capital markets, a number of themes emerge that will influence behavior and activity throughout 2025. Monetary policy decisions, increased consolidation and evolving market dynamics will drive meaningful shifts for all players in the space. Baird’s European Debt Capital Markets team offers our point of view on four key themes shaping Europe’s debt capital markets landscape in 2025, including:

- Interest rate cut strategies in Europe and the U.K.

- Rising tide for direct lending fund consolidation and joint ventures

- Technicals influencing lender behaviour

- Driving growth with NAV loans

These themes highlight the opportunities and challenges ahead for investors and market participants in the European debt capital markets.

Monetary Policy in Focus: Interest Rate Environment in Europe and the U.K.

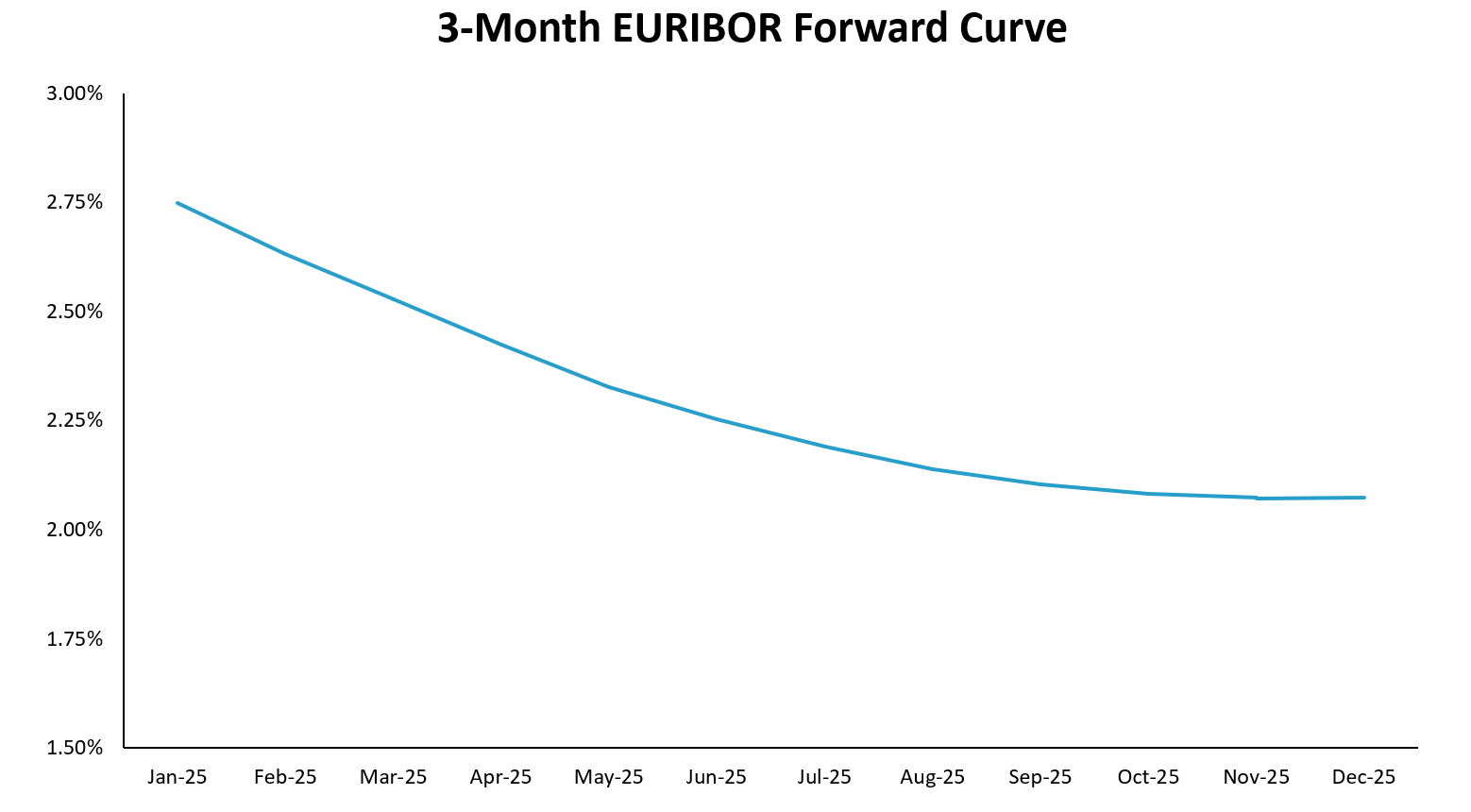

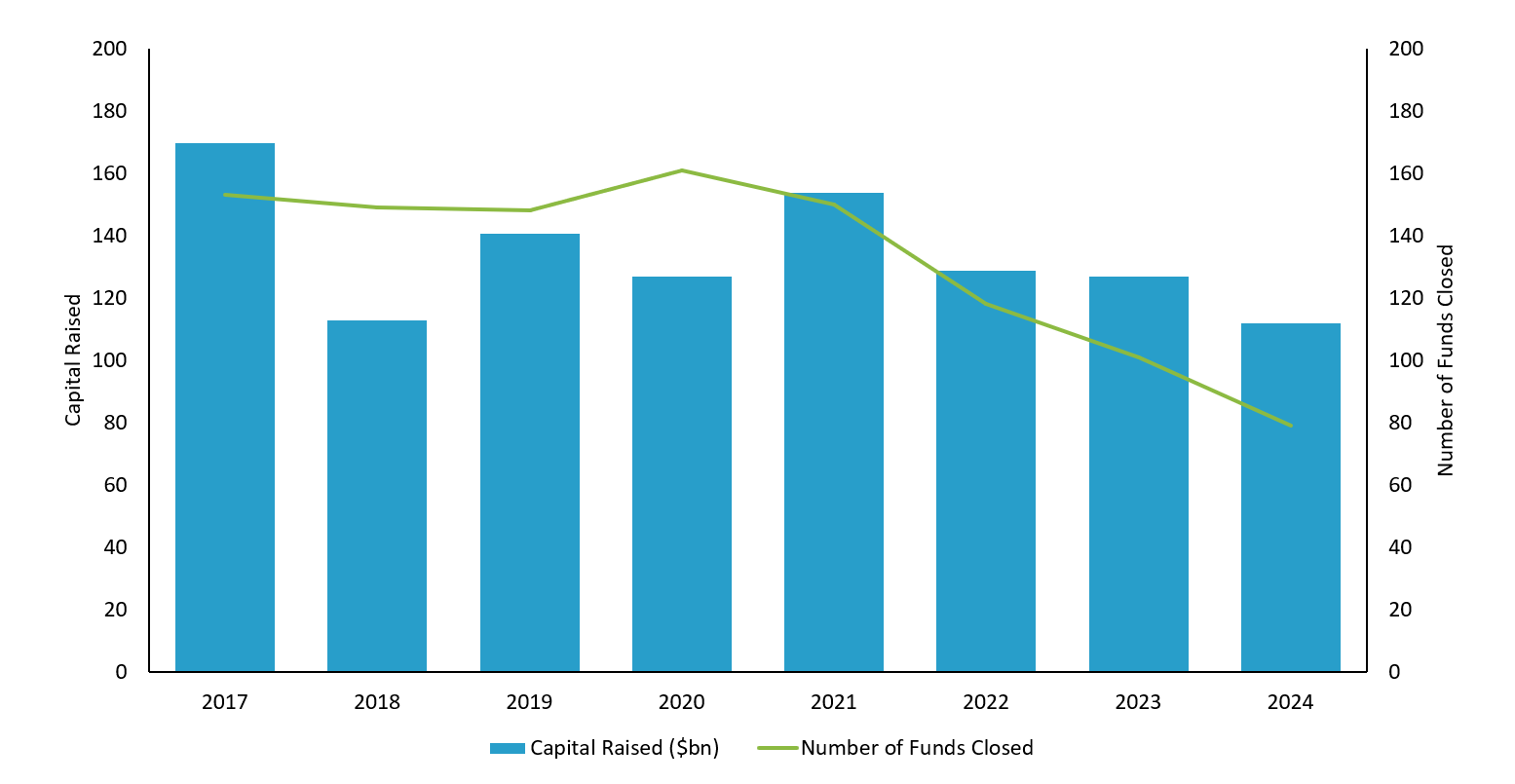

As 2025 starts to unfold, the Bank of England (BoE) and the European Central Bank (ECB) are each charting downward courses in monetary policy, with the forward EURIBOR curve showing a steeper decline that that for SONIA during the first half.

Source: Chatham Financial

Any divergence comes from the varying economic conditions and inflationary pressures across regions which has seen ECB be more aggressive in cutting rates throughout 2024. The U.K. saw a slower pace of easing last year and is forecast to implement at least three quarter-point rate cuts in 2025, although one policymaker has recently made a case for up to 6 rate cuts, from the current 4.75%. The wide range of opinions reflects the tension between continued inflationary pressures largely driven by strong wage growth and service sector, and the need to stimulate growth. The ECB’s path appears clearer, with earlier cuts expected reflecting a eurozone economy that is less burdened by inflation and more focused on combating stagnant growth. As private debt funds target absolute returns, recent higher reference rates have provided scope to tighten margins. However, as rates reduce, credit spreads may well widen again to maintain target returns.

Direct Lending Fund Consolidation / Joint Ventures

The combination of a tough macro environment and a highly competitive direct lending market, underpinned by growing investor demand for the asset class, is creating a compelling consolidation opportunity in European private credit. There are some well documented acquisitions in the last couple of years, including, but not limited to Nuveen acquiring Arcmont Asset Management, Clearlake Capital acquiring MV Credit, AXA IM acquiring CAPZA and BlackRock’s recent acquisition of HPS Investment Partners. These acquisitions provide investors access to a strong performing asset class and facilitate direct lending teams’ access to well established fund-raising teams improving what can be a challenging and time-consuming pursuit.

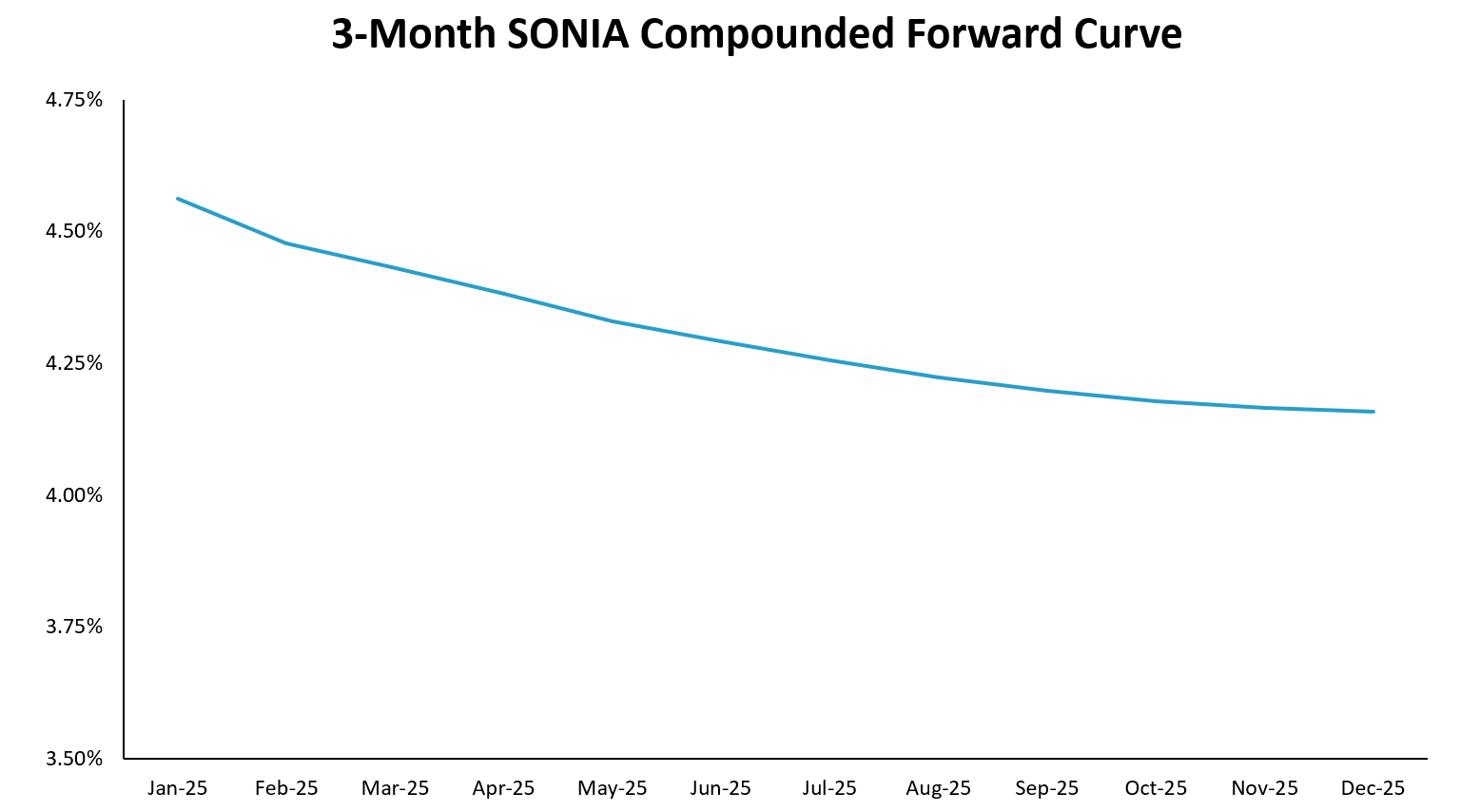

Private credit fundraising pressure is expected to continue throughout 2025 with smaller mid-market generalist funds facing challenges as the industry trends towards larger funds with longer-term track records raising jumbo funds (e.g., Ares’ latest €17.1 billion flagship European direct lending vehicle). Private debt funds without scale or a particular sector or instrument-type specialisation are finding fundraising more difficult which means scaling back ambitions or extending fundraising periods, as evidenced by the material drop off in the number of funds closed in 2024 vs. prior years.

European Fundraising

Source: Private Debt

The slow churn of portfolio assets is also impacting fundraising as private equity investors hold on to assets for longer than they have in the past, reducing LP liquidity for the next fundraise. LPs want to see strong DPI metrics, and for those funds with longer hold periods, this is comparatively low.

Competitive pressures are not limited to funds with banks also experiencing headwinds as they struggle to compete on ticket sizes and, with unitranche margins near historic lows, a reduced pricing discount compared to funds, eroding a key competitive thread. Rather than directly competing, however, banks are continuing to partner up with funds to offer an integrated solution. A more recent example includes Lloyds’ and Oaktree’s senior loan partnership, alongside already established partnerships such as SMBC and Park Square and HSBC and HSBC Asset Management. Baird expects banks to continue exploring such partnerships and new innovative strategies in 2025 to compete in an increasingly competitive market.

Market Technicals Driving Lender Behaviour

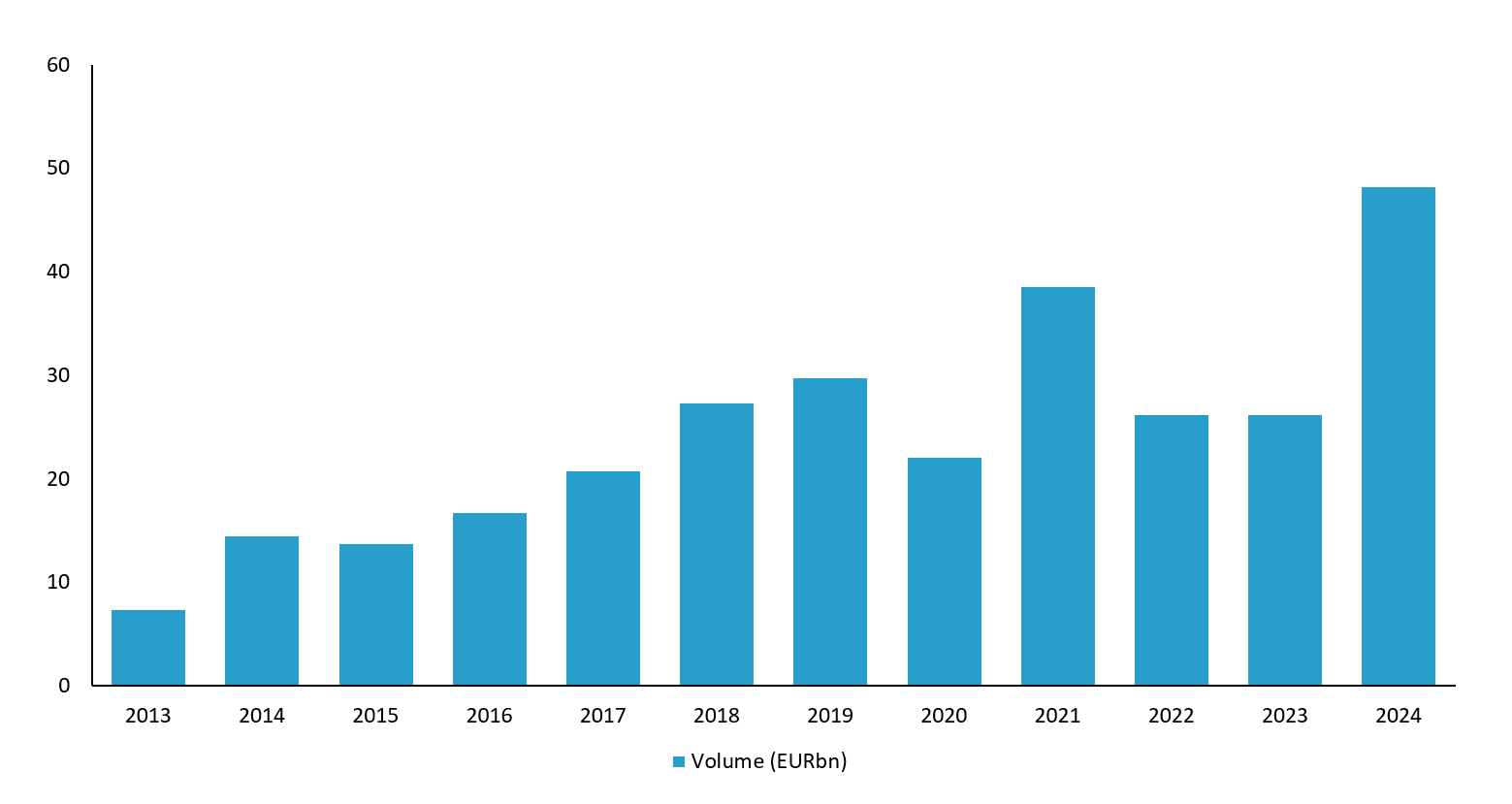

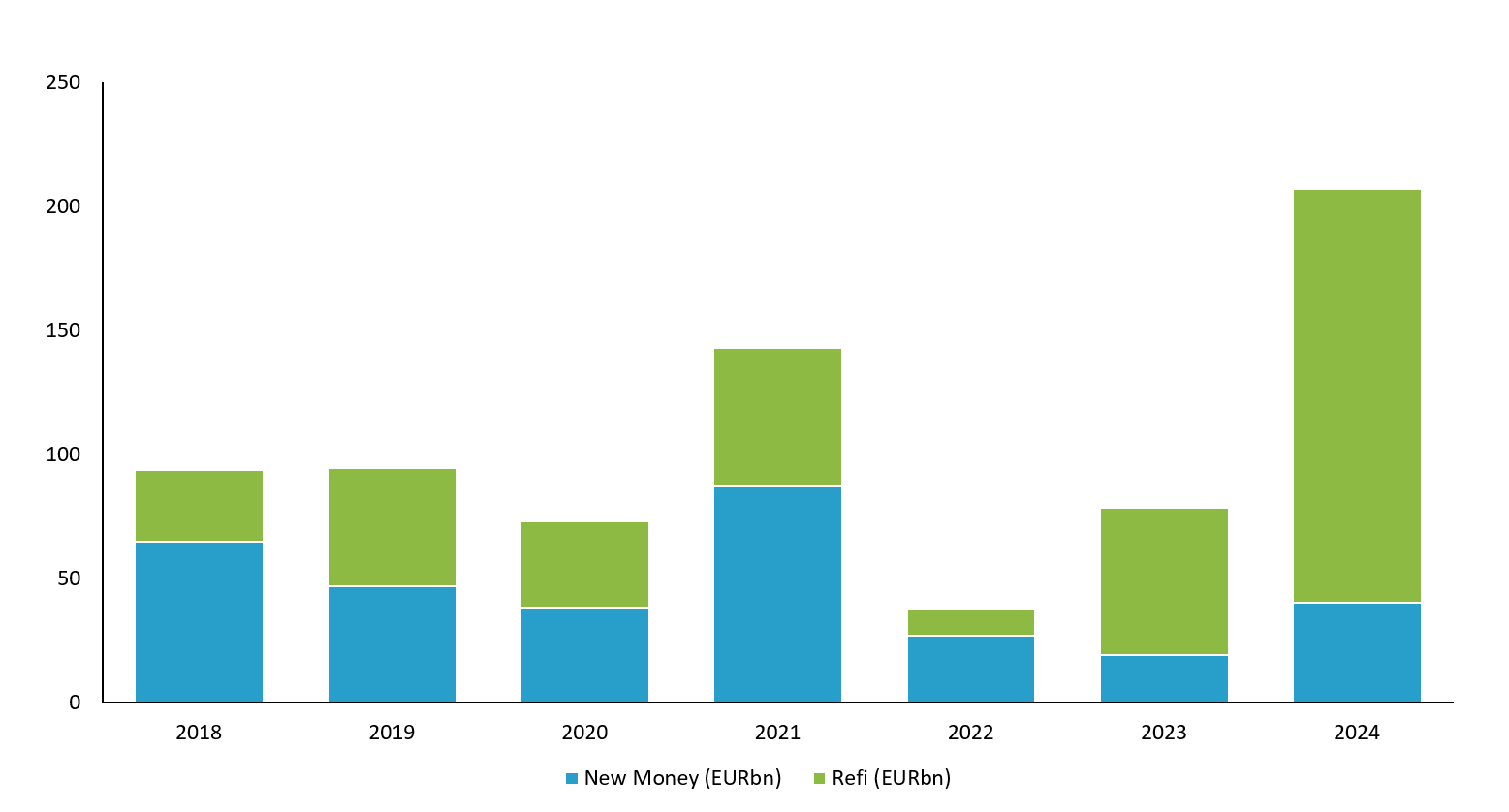

In 2024, the broadly syndicated loan (BSL) markets reopened as credit investor sentiment improved, boosting collateralised loan obligation (CLO) issuance, which had a record year. As a result, syndicated loan activity increased and drove a repricing of recent jumbo unitranche structures coming out of non-call periods. Overall institutional leveraged loan volume reached €207 billion in 2024, setting a new record vs. €114 billion in 2021. However, new money deals remain limited.

European CLO New Issuance Volume

European Institutional Loan Issuance

Source: Pitchbook, Debtwire

Limited new money deals and ample dry powder, specifically for those larger funds that faced capital market repricings, has further increased competitive pressure. Given the higher rate environment discussed above, this competition has more recently emerged in tighter pricing as leverage reduced as 2024 progressed. Data for 3Q24 shows that average margin on direct lending deals decreased to 560 basis points over the reference rate, the third-lowest level on record.

Direct Lending – Pricing vs. Leverage

Source: Debtwire

Material dry powder driving margin compression and competition is expected to continue in 2025. Furthermore, lender behaviour is increasingly driven by fund raising activity and, with LPs applying pressure on management fees and carried interest, there is even greater incentive to deploy capital at a faster rate. Not only has the reopening of the BSL market impacted dry powder and pricing dynamics, some larger-cap funds previously distracted by the capital markets opportunity are now firmly back in the mid-market, which is adding to the competitive pressures. For high-quality assets, Baird is noticing large-cap / upper-mid market terms being pushed down into mid / lower-mid market transactions. This includes covenant-lite structures (or covenant-loose with uncapped adjustments), wider debt incurrence tests and flexible liability management structures. It is expected that for 2025 debt processes with strong competitive tension, highly flexible mid-market structures will be possible.

NAV Loans Being Used as a Tool for Growth

Over recent years, we have noted the shift towards net asset value (NAV) facilities being used to increase investment capacity, support new platform investments, and fund follow-on investments in existing assets or value creation initiatives for portfolio companies. This is allowing GPs to deploy closer to 100% of their commitments, enhancing returns and lowering the proportion of management fees paid relative to invested capital.

NAV lenders have focused on providing facilities to high-performing sponsors, but more recently, small-cap and mid-market sponsors are becoming further educated and using these structures to optimise returns. Higher interest rates and longer hold periods have created a liquidity squeeze resulting in GPs exploring different options to increase fund capacity and generate enhanced value. While the NAV market is currently underserved compared to direct lending, an increasing number of GPs and LPs are showing interest in the product. Recent examples include the joint venture between Investec Bank and Ares, as well as HSBC Asset Management launching its first vintage of a NAV financing strategy ($1billion fund target with an anchor investment from HSBC Group). As the demand for NAV outpaces the available supply, Baird expects more market participants to enter the space, bringing further liquidity and competition.

Historic private equity LP pushback on such NAV structures has been centred around lack of transparency (around the use of funds) and synthetic DPIs (given potential capital calls as loans mature). Investor education has helped to alleviate this pushback as it has become clear that NAV structures are predominantly being used to increase investment capacity and fund new platform acquisitions, follow-on investments and value creation initiatives rather than investor distributions. As usage broadens and GPs continue to educate investors, we expect LPs to become more comfortable with this as a route to create value for all parties throughout 2025.

Contact a member of our European Private Capital Markets - Debt Advisory team to learn more.

Andrew Lynn

+44-20-7667-8529

anlynn@rwbaird.com

James Jewers

+44-73-5036-1392

jjewers@rwbaird.com