5 Themes That Will Shape the U.S. Private Debt Markets in 2025

Middle-market borrowers enjoyed healthy and competitive debt financing markets throughout 2024. The expectation and eventual execution of rate cuts by the Fed, the favorable supply/demand dynamics among private credit funds and the reopening of the broadly syndicated loan (BSL) market all contributed to tightening spreads and improved credit terms for worthy borrowers.

Many of these dynamics persist as we embark on 2025. Baird expects continued strength in the U.S. debt financing markets for middle-market borrowers coupled with a rise in activity as M&A markets rebound. Our sentiment is rooted in five themes we expect to drive market conditions in 2025:

1. Guarded Optimism for Continued Rate Cuts

After nearly two years of rate hikes, the market entered 2024 at a peak fed funds rate target of 5.25-5.50% but optimistic of imminent rate cuts in the year ahead. Specifically, the Federal Open Market Committee (FOMC) was signaling three 25 basis point rate cuts in 2024 to end the year at ~4.6%, while the market was more optimistic, expecting 3.9% by year-end. Despite a slower-than-expected start to the series of cuts, we saw three consecutive rate cuts beginning in September of 50 basis points, 25 basis points and 25 basis points resulting in a target range of 4.25-4.50% to close the year, surpassing the FOMC’s expectations but falling shy of the market’s expectations.

Looking forward, the FOMC’s median estimate for year-end 2025 is 3.75-4.00%. This hides a relatively wide dispersion of estimates among the constituents spanning 3.00-3.25% to the current 4.25-4.50% (no rate cuts), potentially reflective of uncertainty around the incoming administration’s policy agenda.

FOMC Outlook for Fed Funds Rate

Depicts each FOMC member’s opinion on where the rate should be at the end of the year

Source: Federal Reserve.

Note: Latest data as of December 2024. “Longer Run” is not defined by FOMC

Markets will be keeping an eye on inflation and particularly the impact of some of the incoming administration’s potential policies. Higher tariffs and mass deportations could worsen inflation, and while tax cuts and deregulation could spur economic growth, this growth could fan inflation amidst a labor shortage. Conversely, slower growth or a decline in the labor market could prompt more aggressive rate cuts.

What does this mean for borrowers? Amidst what seems like a higher, though uncertain, likelihood of inflation-inducing policies going forward, companies may wish to conservatively budget for “higher-for-longer” benchmark rates to reduce the potential downside impact of interest rates on their financial performance.

2. Competitive Dynamics Driving Private Credit Flexibility

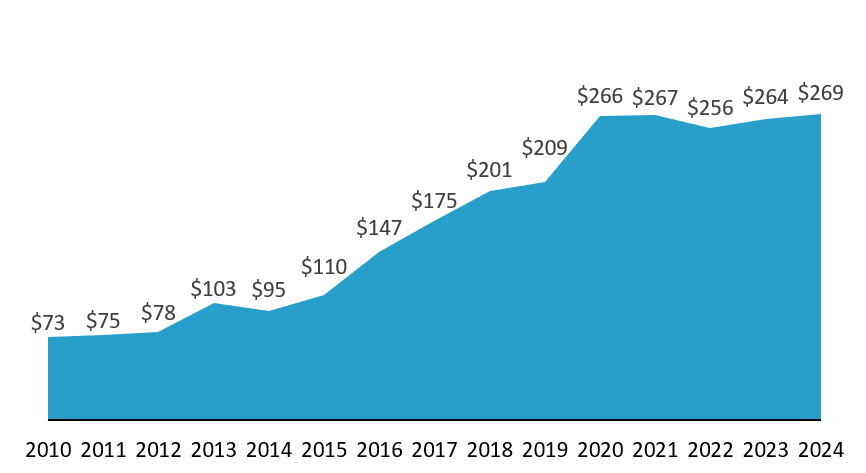

Following several years of robust fundraising by private credit (though notably 2024 was down 15% from 2023(1) ) coupled with a market-wide slow down in M&A, private credit funds have amassed record dry powder leading to a borrower-friendly supply/demand dynamic.

North American Private Credit Dry Powder ($bn)

Source: Preqin.

Note: Annual dry powder for North American private debt consisting of direct lending (senior, unitranche, junior, blended), mezzanine, special situations, distressed and venture debt. Prequin recently changed its data collection methodology, leading to historical figures being retroactively adjusted since our last publication in early 2024.

This competitive tension has helped drive spreads down. In 2023, only 6% of leveraged buyouts (LBOs) financed in direct lending market had spreads below 550, whereas in 2024 this rose to 40%.(2)

Given minimum return thresholds, direct lenders can only push so hard on pricing. In order to win deals, lenders have been increasingly constructive in other ways, including covenant flexibility, payment in kind (PIK), and delayed draw term loans (DDTLs). Needless to say, these concessions are reserved for the more attractive credits, and the threshold for them has not been compromised despite the competitive environment.

- An LCD survey from November 2024 found that 52% of respondents expect covenant terms in the core middle market to loosen in the next few months, compared to only 12% expecting them to tighten.

- This sentiment is less pronounced for lower middle market companies, though more respondents still expect them to loosen (34%) vs. tighten (23%).

- An LCD study of BDC filings from October 2024 found income from PIK rising over the prior two years from $343 million to $967 million with the proportion of PIK vs. interest and dividend income rising over the same period from 7.6% to 9%.

- The count of new issue private credit financings with DDTLs increased in 2024 by 129% over 2023 to a record 268.(3)

Amidst the strong LP interest in private credit, we expect not only to see direct lenders getting aggressive to win deals in their core legacy strategies, but also increased focus and deployment across other strategies, like asset-backed (ABL), net asset value (NAV) and opportunistic loans. In particular, non-bank ABL lending has seen tremendous growth, rising from $8.5 billion in 2020 to $26.5 billion in 2024.(4) Though deal volume is still heavily weighted towards banks, over this period non-banks have taken share on both a volume and deal count basis, with share of volume rising from 22% to 34% and share of deal count rising from 62% to 73%.(4) And looking forward, a Preqin survey to private credit investors found that 55% believe ABL lending will present the strongest opportunities in the coming year, the highest proportion by far of any option.

3. Significant Tailwinds to Drive Debt Financing Activity

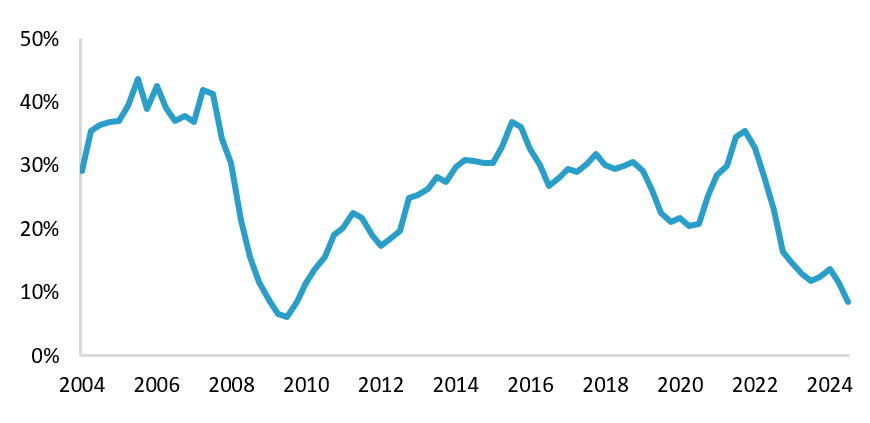

Following a decline in distributions to paid-in capital (DPI) to a 15-year low for the 12-month period through Q3 2024 – DPI for the period was 9%, paling in comparison to the 2014-2023 average of 27%, according to PitchBook – pressure on GPs to find ways to distribute capital has increased significantly.

Buyout Fund Distributions as a % of Beginning NAV

Source: PitchBook. Data points are calculated on a trailing 12 month basis.

Latest data is through September 30, 2024.

Note: The distributions for the two most recent quarters were estimated from exit value.

Unsurprisingly, dividend recapitalizations (recaps) surged in 2024. In private credit, recap volume YTD through Q3 more than doubled to $13.6 billion year over year.(5) In the institutional loan market, recap volume surged 306% in 2024 vs. 2023.(2) We expect a continuation of this trend in 2025.

Furthermore, an upcoming private equity fund maturity wall will add further pressure for DPI and drive the need for traditional exit paths, like M&A and IPOs, as well as alternative solutions like continuation vehicles, which may carry refinancing needs. At the end of Q3 2024, the average holding period of current U.S. private equity portfolio companies rose to 5.4 years, an increase of a half year from 2019, while 52% of all active private equity funds are six years or older.(6)

Promisingly, M&A market activity should accelerate in 2025 after mixed results in 2024. Positive indicators include an increase in H2 2024 deal values of 11% over H1 as well as a rise in U.S. private equity M&A exits tracking to 25% in 2024 on a deal count basis. (7,8) Further, a Baird study of past M&A cycles suggests the potential for 20%+ annual deal growth in 2025 based on observed growth in M&A deals with announced value of $1+ billion (25%) and private equity M&A exits in 2024. Market participants share the sentiment: A recent LCD Survey found 74% of participants expect deal activity to increase over the next 90 days.

For an extensive analysis of 2025’s M&A markets, see Baird Global Investment Banking’s 2025 M&A Market Outlook.

4. Tension Between BSL and Private Credit in Upper Middle Market

Following a challenging 2023 for the BSL market that saw private credit command the vast majority (92%) of the “steals” (one market refinancing a credit from the other), the BSL market reopened in 2024 in a meaningful way seeing $470 billion of issuance volume compared to $226 billion in 2023. Naturally, the flow between markets evened out with private credit owning only 47% of the steals in 2024. As 2025 begins, borrowers are prudently increasingly running dual-track processes between the BSL and private credit markets to ensure optimal financing outcomes.(6)

BSL and Direct Lending Takeouts ($bn)

Source: PitchBook LCD

Latest data is through December 31, 2024.

Note: DL = Direct Lending | BSL = Broadly Syndicated Loans

As it pertains to LBO activity, private credit held a slight edge over the BSL market in 2024 on a volume basis (54%) and a more pronounced edge in terms of deal count (84%).

In 2025, larger borrowers with attractive credit attributes are poised to benefit from this competitive tension across markets. Such borrowers should always give due consideration to a dual-track process to ensure the best the market has to offer.

5. A Rejuvenated Bank Lending Environment

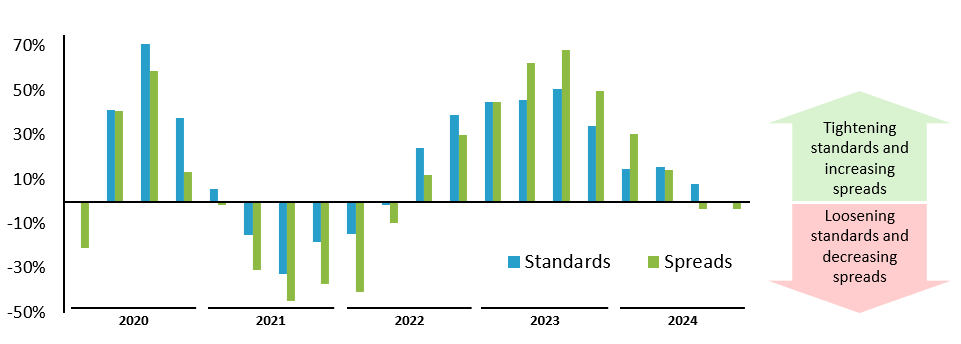

The bank lending environment enters 2025 on a more positive tone than at any point over the past two years. Indeed, a quarterly Fed survey of senior loan officers at large and medium-sized banks shows a net percentage of respondents tightening standards on commercial and industrial (C&I) loans at or below zero for the first time in Q4 2024 since Q2 2022.(9) Similarly, the net percentage of those increasing spreads of loans went negative in Q3 2024 for the first time since Q2 2022.(9)

FED Senior Loan Officer Survey

Source: Federal Reserve

Latest data as of October 2024 Senior Loan Officer Survey on Bank Lending Practices

As direct lending has become a more prevalent financing option for companies, banks have looked for ways to access this market. A strategy that has gained momentum is to partner with private credit investors to create a joint fund. Banks can leverage their relationships to originate these loans (also benefitting direct lenders) and provide their customers access to another source of financing while keeping these loans (which don’t pass leveraged lending guidelines) off their balance sheets.

Select Recent Bank & Private Credit Partnerships

| Date | Bank | Private Credit |

| January 2025 | BMO | Canal Road |

| September 2024 | Citi | Apollo |

| September 2024 | BNP Paribas | ATLAS SP (Apollo) |

| July 2024 | Webster Bank | Marathon |

| June 2024 | Stifel | Lord Abbett |

| May 2024 | PNC | TCW |

| April 2024 | Barclays | AGL Credit Management |

| January 2024 | Citi |

LuminArx |

| September 2023 | Wells Fargo | Centerbridge |

Going forward, market participants will undoubtedly pay close attention to the incoming administration for any signs of deregulation in the banking sector, which could provide further tailwinds for lending activity by banks to the benefit of corporate borrowers.

In conclusion, the U.S. debt markets enter 2025 in a position of strength. While the macroeconomic picture is somewhat uncertain, it is on stronger footing than a year ago. We expect deal activity to be more robust than in 2024. Borrowers should benefit from strong technical factors driving deployment appetite from private credit funds and an improved bank lending environment. For those with potential debt financing needs, now is as good a time as ever to access the debt markets.

Baird’s Private Capital Markets team can help you evaluate, define and pursue your financing objectives. Contact our team to discuss any potential financing needs or capital structure objectives.

Sources

(1) Preqin

(2) LCD Comps

(3) Loan Connector

(4) SFNet

(5) DL Deals

(6) Pitchbook

(7) Baird

(8) Dealogic

(9) Federal Reserve