Nuanced European PE Market: Record Deployment & Fall in H1 2022 Exits

Investment Banking

Lower private equity investment activity in recent months shows signs of weaker underlying market conditions

- Strong European mid-market PE investment continued in H1 2022 despite a decline in the overall M&A market

- Continued “flight to quality” as PE firms and lenders assess inflation-resilience and downside scenarios of targets

- Sector activity reverts to Covid mix – technology, services and healthcare took share from industrial and consumer

- Nordics overtakes DACH as third most active region – Nordics return to share of activity not seen since 2015

- European debt funds, with $125bn of dry powder, supporting PE activity – lending decisions increasingly binary

- PE exits down 30%, driven by decision not to sell certain portfolio companies in H1 2022 – sector mix of vintage portfolio companies skewed more towards cyclical sectors than the more resilient sectors being invested in now

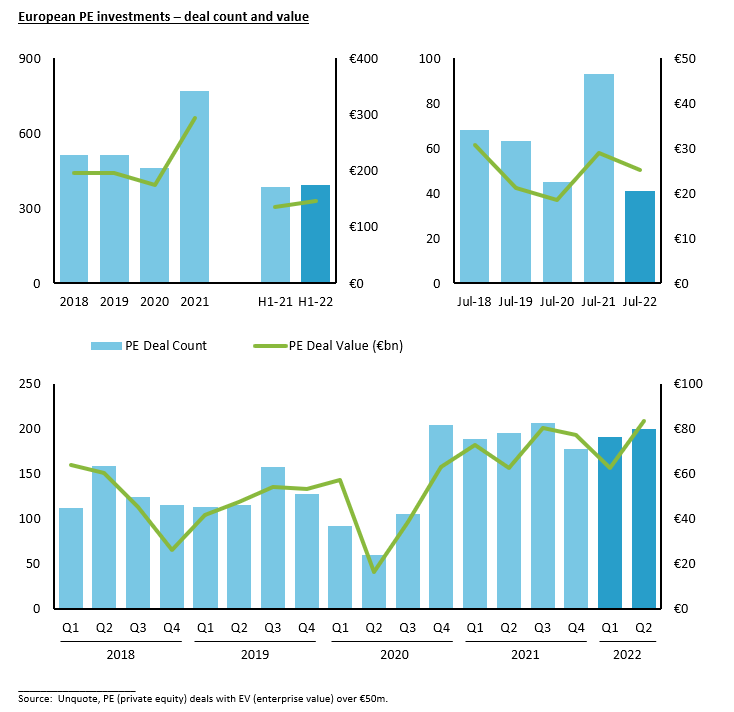

- Increasingly cautious sentiment led to a 55% drop in PE investments in July, the least active month for two years

- European PE dry powder of $418bn at record levels – more stable macro environment could bring an uptick in PE investment and exit activity as we approach 2023, though PE activity in Q4 2022 will likely be lower than Q4 2021

Strong PE deployment continued in H1 2022 despite decline in overall M&A market

European mid-market private equity deal count and deal value increased 2% and 8% respectively in H1 2022, compared to H1 2021. This level of PE investment represents a high watermark for the first half of any year. In contrast, overall European M&A activity in H1 2022 was down nearly 20%, both in terms of deal count and deal value. The M&A market was not immune to the unique macroeconomic conditions, including unprecedented inflationary pressures, supply chain disruption and the invasion of Ukraine by Russia in February 2022. However, PE firms successfully continued to deploy capital in this choppy M&A market, finding companies that meet their high standards of quality and resilience. We look deeper across geographies and sectors to reconcile the strong PE deal activity in H1 2022 and the increasingly cautious sentiment that consequently led to a 55% decrease in PE deal count in July.

PE exits down 30% – secondary buyouts account for majority of exits

Private equity firms, and their M&A advisors, have been thoughtfully weighing up the pros and cons of launching any sale process in H1 2022, especially after Russia’s invasion of Ukraine in February 2022. Many of their best portfolio companies, that might be more resilient to the macroeconomic effects of the war (and subsequent sanctions), were already sold in 2021. However, PE firms continued to launch sale processes in this choppy, yet open, M&A market:

- High quality assets that would garner significant buyer interest, a strong valuation and ample lender appetite

- “Must-have” strategic platforms where corporate acquirers can benefit from significant revenue / cost synergies

- Company / sector specific factors e.g. sustainable post-Covid momentum supporting robust financial forecasts

- Shareholder specific factors e.g. liquidity event before fundraising, last portfolio company within an older fund

A substantial number of sale processes, being prepared in Q4 2021 for launch in Q1 2022, successfully transacted in H1 2022. There was also a relatively high proportion of live deals in the market that did not transact due to:

- Increasing gap between buyer and seller valuation levels, including different views on EBITDA adjustments

- Lenders setting a high bar – lower appetite for assets or sectors that are perceived to be cyclical or less resilient

The fall in PE exit activity reflects a decision by sponsors not to sell certain portfolio companies in H1 2022. The sector mix of vintage portfolio companies (acquired pre-Covid) is skewed more towards cyclical sectors than the more resilient sectors being invested in now. The proportion of PE portfolios with technology and healthcare assets held for over 3 years is notably lower than the 35% share of technology and healthcare PE investment activity in H1 2022.

Like the US, the European IPO market has effectively been closed for much of 2022 as equity markets have been challenged by geopolitical and macroeconomic volatility. Private equity has partially filled the void with secondary buyouts accounting for a record 62% of European PE exit value in H1 2022. Despite a “risk-off” deployment strategy by some PE firms in 2022, they have still managed to acquire attractive companies where they have a specific angle.

Unique macro conditions drive continued “flight to quality”

Each recession is unique, from the global financial crisis in 2008 to the Covid lockdown in 2020. The Russian invasion of Ukraine has accelerated the slowdown in the global economy, with much of Europe now forecast to deliver near flat GDP growth in 2023. The cost of living crisis is expected to continue until H2 2023 according to the European Central Bank and Bank of England, both of which are raising interest rates to combat record inflation.

PE firms, and lenders alike, are carefully assessing business plans of potential targets to include a recession or downside scenario. We have seen a continued “flight to quality” as PE firms, eager to deploy their dry powder, are willing to pay up for the best, most resilient, assets. This trend has been exacerbated in H1 2022 relative to 2021 given the scarcity value of such “A grade” assets due to the fall in overall PE exit activity. However, we have seen a slight decrease in average valuations as PE buyers test lower bids for “B grade” assets relative to the peak in 2021.

Sector mix reverts to most resilient sectors

Mid-market PE investments by sector in H1 2022 reflected a mix similar to 2020 and H1 2021, during the height of Covid. Software & technology, services and healthcare took share from consumer and industrial relative to H2 2021.

The share of software & technology deals, though high in H1 2022, was lower than its record 28% in H1 2021 as a fall in publicly listed tech valuations impacted private markets. Profitable, growing, cash generative software companies continued to see high valuations from PE firms while some earlier stage tech companies delayed their sale processes.

The 22% share of services transactions in H1 2022 represented a high watermark. Business models with long term customer contracts and strong net retention rates are relatively more attractive in a recessionary environment. PE firms are increasingly targeting higher growth subsectors such as GRC (governance, risk & compliance) and ESG (environmental, social, governance) services. The highest valued services transactions were secondary buyouts of successfully executed buy-and-build platforms, reaping the benefits of revenue synergies through cross-selling.

The 12% share of healthcare deals in H1 2022 was also a new record. PE firms are allocating a greater share of their funds to healthcare given the sector’s resilience to economic cycles, underlying growth from Europe’s aging population and pent-up demand / backlog after the pressure placed on healthcare systems from Covid. PE firms are also embarking on new ambitious strategies, including creating pan-European healthcare buy-and-build platforms.

Post-Covid resurgence of certain subsectors

The global economy has struggled with the uneven recovery of subsectors after the initial Covid lockdown in 2020 and after the vaccine rollout in 2021. Even in the current recessionary climate, we are seeing certain companies suffer from labour shortages while other companies have started laying off some of their staff. Subsectors that are benefitting from the post-Covid resurgence have seen an increasing number of companies enter the M&A market. The timing and sustainability of the recovery has changed the subsector M&A mix within industrial and consumer.

For example, short cycle subsectors, such as building products, accounted for a larger share of industrial PE activity in H1 2021. The longer cycle subsectors, such as industrial machinery, accounted for a larger share of industrial activity in H1 2022. As leadtimes in the semiconductor supply chain began to normalise from record high levels in Q4 2021, we saw an increase in PE investments within electronic equipment and automotive parts in H1 2022.

The cost of living crisis has significantly reduced the disposable income for much of the world’s population, including in Europe. This reduced spending on discretionary items has halved the number of PE deals in the retail subsector in H1 2022 relative to H1 2021. At the same time, fewer Covid restrictions on international flights has allowed the travel & leisure subsector to recover to near pre-Covid levels, leading to a doubling of subsector PE activity in H1 2022.

Sector mix varies significantly by region

Our analysis of PE investments by sector shows stark differences between regions as well as the speed at which the sector mix can change in 6 months. The UK has the highest share of healthcare and financial sector deals, while Italy and Spain have the highest share of consumer transactions. Both France and DACH have seen an increase of over 50% in the services sector in H1 2022, driven across business models and subsectors from consulting to education.

Nordics overtakes DACH as third most active region

The regional mix has stayed steady in H1 2022 relative to 2021, except for a pronounced shift of PE activity from DACH to the Nordics. With a 16% share of all mid-market European PE investments, the Nordics returned to a share of activity not seen since 2014 and 2015. However, the sector mix in the Nordics has changed considerably in the last 8 years, from industrial and consumer to technology and services, of which 50% were primary PE deals in H1 2022. The closure of the IPO exit route has increased the flow of Nordic M&A opportunities for private equity this year.

Higher proportion of primary deals

European PE firms have successfully been acquiring more companies directly from founders, family owners and management teams, accounting for almost half of PE deal count in H1 2022. Since Covid, these vendors have been evaluating the proportion of their personal wealth that is “tied up” in their company shareholdings. Many decided to take advantage of the high valuation environment and sell part of their shareholding to a PE firm in a primary deal.

The share of secondary deals has also been rising given the ever-increasing number of private equity portfolio companies. This source of M&A supply contributed to almost half of PE deal value over the last 18 months.

P2P (public-to-private) M&A activity continued in H1 2022 as private equity firms saw relative value given significant declines in the equity markets as well as the usual benefit of access to readily available company data. Many publicly listed companies, caught in a broad market downturn, were viewed as having share prices not reflective of company specific financial performance. The majority of P2P deals in H1 2022 were of companies headquartered and listed in the UK, with the remainder in the Nordics. As large-cap funds get bigger, their appetite for megadeals continues.

Debt funds have supported PE activity – lending decisions now increasingly binary in nature

Russia’s invasion of Ukraine significantly impacted the public credit markets, which posted a loan volume of €9bn in Q2 2022, the lowest quarterly figure since the Eurozone debt crisis in 2012. Dislocation in the public syndicated loan and bond markets accelerated the penetration of private credit across Europe’s leveraged finance space in H1 2022. Debt funds have taken market share in the mid-market over the last decade and have now demonstrated their ability to finance large-cap PE deals through unitranche clubs, increasing the average size of direct lender deals in Q2 2022.

Terms received from Baird’s mid-market lender processes (as part of our European sell-sides) in H1 2022 continue to show strong leverage levels, estimated at being half a turn lower (0.5x debt / EBITDA) than would have been pre-Russia’s invasion. We are seeing unitranche pricing increase by 50 – 100bps, taking current margins to 675 – 700bps or higher. We expect debt funds will take further share from traditional banks in the mid-market, but will also be highly selective. Lenders are focusing on downturn scenarios in this recessionary environment, leading to increased bifurcation among sectors and credits that demonstrate resilience vs. those that are perceived to be more cyclical.

Growth capital trend similar to PE activity

Like European mid-market PE activity, growth capital deal count in H1 2022 was as high as H1 2021 and then fell by 65% in July 2022. Growth equity investors are now more cautious, considering only opportunities of the highest conviction while favouring inside rounds as opposed to being diluted in a material down round by third party investors. Given recent equity market declines, particularly for earlier stage technology companies, growth equity investors are targeting companies with positive cash flow or minimal burn. Term sheets are also being negotiated to include investor‐friendly terms such as higher downside protection, more governance, and control over timing of their exit.

Private equity’s different approaches to ESG

ESG (environmental, social, governance) has become an increasingly important criteria for LPs assessing GPs, and a growing proportion of PE firms, now totalling $2tn of assets under management globally, have specific ESG commitments. However, the approach taken by private equity to ESG is not uniform. Some PE firms are investing in the transformation of targets from “brown to green” while others are avoiding end markets with high carbon intensity. These ESG driven “go / no go” decisions are contributing to a lower number of bids for certain assets in H1 2022.

Some PE firms have an ESG roadmap for each portfolio company, supporting CEOs to construct and implement an ESG framework across the company’s employees, customers and suppliers. In Baird’s sale processes, we have seen potential buyers, particularly impact funds, value the tracking of relevant KPIs to evidence a target’s ESG impact.

PE fundraising continues, but at a lower level

Success breeds success – European buyout firms continued to raise larger funds with the average fund size reaching €1.7bn in H1 2022, double pre-Covid. €42bn was raised in H1 2022, 15% down from H1 2021 which benefitted from pent-up demand post Covid lockdown. LPs want to see a track record of recent successful exits and are asking GPs for more analytical detail to understand precisely what is driving portfolio returns.

A number of mid-market GPs are struggling to raise their target amount this year due to a congested fundraising market and LP reallocation of capital to balance their private market exposure following the sell-off in public equities. Difficulty in scaling up their new funds has also been exacerbated by large-cap buyout firms that have already taken the majority of LP allocations over the last 12 months. Some mid-market GPs are therefore deferring fundraising to 2023 in the hope of a less crowded market. However, with record levels of dry powder and larger average equity tickets, GPs are still under pressure to deploy capital. Many GPs therefore endeavour to invest in buy-and-build platforms with actionable add-on opportunities to deploy further capital, often at lower valuation multiples.

Potential for uptick in PE activity in Q4 2022

A relatively low level of private equity and growth capital deal announcements is likely to continue for the remainder of Q3 2022. However, there are a high number of mid-market sale processes in the preparation phase after a busy period of sell-side pitch activity across Europe in H1 2022. We could therefore see a near term pickup in Q4 2022, though PE deal activity in Q4 2022 is likely to be lower than Q4 2021. A proportion of sale processes will move into 2023, where targets can evidence robust financial performance in 2022 before launching into the M&A market.

Despite sluggish GDP growth forecasts across Europe in the near term, there will be winners and losers from today’s macroeconomic dislocation. Any material improvement in the macro environment, from lower inflation to supply chain normalisation, by the end of 2022 could enable a sustained level of PE investment and exit activity in 2023.

Contact a member of our European team to discuss these trends in further detail: