As a Baird Client, you or your tax preparer may download your Baird Consolidated 1099 (e.g., Forms 1099-DIV, -INT, -OID, -B, and -MISC) directly into a CSV (comma-separated values) file. The downloaded CSV file can be electronically imported into most tax accounting software, eliminating most of the manual data entry and saving considerable time.

To facilitate the CSV file download process, you need the Account Number and the unique Document ID displayed on your Baird Consolidated 1099. Please follow the instructions below to download your Baird Consolidated 1099 data into a CSV file.

Note: Baird offers a separate service to download the Baird Consolidated 1099 into TurboTax® – click here for information.

CSV File Download Instructions

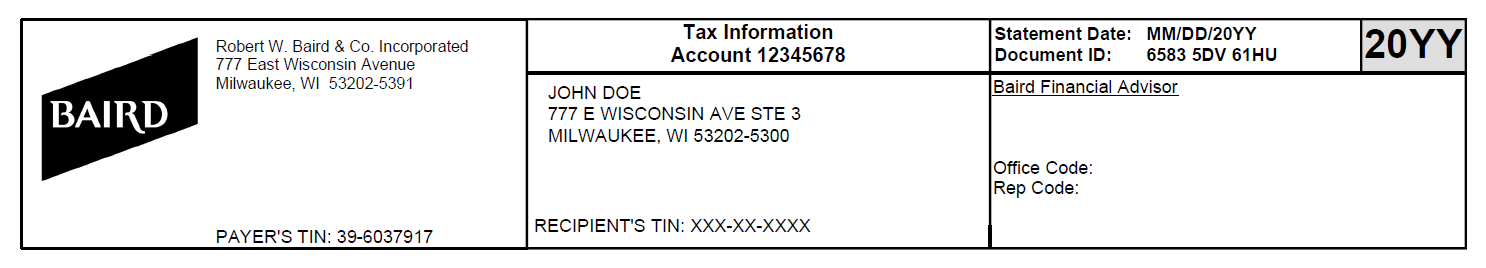

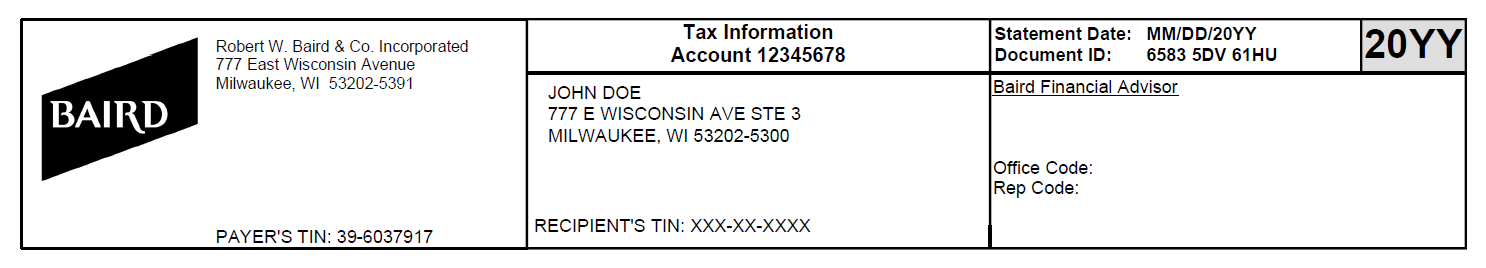

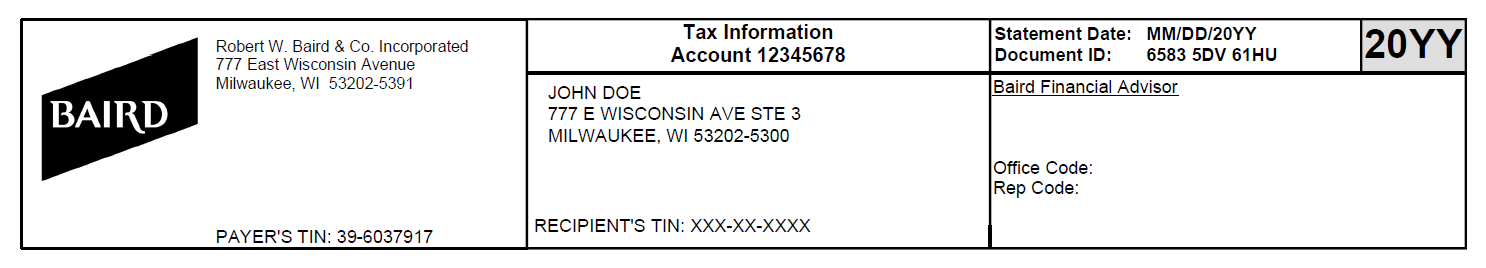

- Prior to starting, you need the Account Number and the unique Document ID displayed on the Baird Consolidated 1099. The Account Number and unique Document ID are located at the top of page 1.

- Access the following secure website: https://taxdownload.wsc.com/csv-547.

- On the “Robert W. Baird & Co. Inc. – Tax Download” webpage:

a. Select the applicable Tax Year in the first drop down box.

b. Type in your Account number as displayed on the Consolidated 1099.

(Note: if you have multiple accounts at Baird, you will need to download each account separately).

c. Type in the unique Document ID as displayed on the Baird Consolidated 1099

d. Select the applicable File Type from the drop-down box – CSV (Note: if your Baird Consolidated 1099

contains numerous pages, there is an option to download your CSV file as a zip compressed file).

e. In the Enter code box, type in the visual code displayed on the screen. (Note: this random code

is used for authentication purposes.)

f. Click the [Download] button.

- Within the File Download dialog box, click the [Open] button. The CSV file will open in Excel (or in another compatible default program).

- Review the data found in the CSV file and compare it against the actual Baird Consolidated 1099 to ensure there are no discrepancies.

a. For the Forms 1099-DIV, 1099-INT and 1099-MISC: the applicable IRS box totals will be downloaded1.

b. For the Forms 1099-OID: the applicable IRS box totals for each security will be downloaded1.

c. For the Forms 1099-B: each applicable detailed transaction will be downloaded.

- Save the CSV file to your computer using a unique file name (note: if you have multiple accounts at Baird, you will need to download each account separately and save each account with a different file name).

- Please refer to the instructions provided by your tax accounting software to complete the import process of the CSV file into your software.

1It is important to note that your tax accounting software may not support the import of all Forms 1099 data contained in the CSV file. Therefore, you may need to manually delete any unsupported Forms 1099 data from the CSV file through a program that is compatible to read a CSV file (e.g., Excel) or through your tax accounting software according to the software instructions.

Baird can only assist you with the technical download of the Baird Consolidated 1099 into a CSV file. If you have any trouble importing a CSV file into your tax preparation software, please contact the software vendor directly.

It is important to understand that the download of the Baird Consolidated 1099 to a CSV file may not contain all information required for you to properly complete the investment income portion of your federal and/or state tax return(s).

Be sure to verify the information that you download with your own records to ensure accurate and complete reporting of all required tax information on your federal and/or state tax return(s). Although Baird is providing the download of the Baird Consolidated 1099 to a CSV file as an additional service, Baird does not guarantee that the information provided is sufficient for tax reporting purposes, and Baird is not liable for your reliance upon or use of the CSV download service or the data provided through such service. If you have specific questions regarding the preparation of your tax return, contact your tax advisor, the IRS, or the state(s) to which you report.

The printed Baird Consolidated 1099 is the official record of Forms 1099 information maintained at Robert W. Baird & Co. Incorporated. Robert W. Baird & Co. Incorporated disclaims any liability arising from the use of the Service, FIS Wall Street Concepts® software and/or the content furnished by or through any third party, including but not limited to, any resulting information obtained from such use, or interpretations of information made as a result of such use.

Click on a question to view the answer.

- What are the benefits of downloading my Baird Consolidated 1099 into a CSV file?

- Who can download their Baird Consolidated 1099 into a CSV file?

- What is the website address used to download the CSV file?

- What information do I need to download the Baird Consolidated 1099 into a CSV file?

- Where do I find my Account Number and unique Document ID on the Baird Consolidated 1099?

- What information from the Baird Consolidated 1099 will be included in a CSV file download?

- If I have multiple accounts at Baird, will I need to download a CSV file for each account?

- What information from Forms 1099-DIV, -INT and -MISC will be downloaded into a CSV file?

- What information from Form 1099-B will be downloaded into a CSV file?

- What information from Form 1099-OID will be downloaded into a CSV file?

- What information from the Baird Consolidated 1099 will not be downloaded into a CSV file?

- Will Partnership distributions be downloaded into a CSV file?

- Will the Baird Form 1099-R or Form 1099-Q be downloaded into a CSV file?

- When will the Baird Consolidated 1099 be available to download into a CSV file?

- If I receive a corrected current tax year Baird Consolidated 1099, will I need to download a new CSV file?

- Will the CSV file import into TurboTax®?

- Who should I contact if I have questions with a CSV file download?

- Who should I contact if I have questions about importing the CSV file into my tax accounting software?

- Why is my CSV file not downloading?

- What are the benefits of downloading my Baird Consolidated 1099 into a CSV file?

A CSV file can be electronically imported into most tax accounting software, thus eliminating most of the manual data entry saving considerable time for you or your tax preparer.

- Who can download their Baird Consolidated 1099 into a CSV file?

Any client (or their tax preparer) who receives a Baird Consolidated 1099 (Forms 1099-DIV, -INT, -OID, -B and -MISC) will be able to download the tax data into a CSV file (note: you do not need to be registered for Baird Online to download into a CSV file).

- What is the website address used to download the CSV file?

You can go directly to the secure CSV file download site at: https://taxdownload.wsc.com/csv-547.

Return to Top

- What information do I need to download the Baird Consolidated 1099 into a CSV file?

You will need your Account Number and unique Document ID, which can be found on your Baird Consolidated 1099.

- Where do I find my Account Number and unique Document ID on the Baird Consolidated 1099?

Your Account Number and unique Document ID are located on page 1 of your Baird Consolidated 1099.

- What information from the Baird Consolidated 1099 will be included in a CSV file download?

The applicable Forms 1099-DIV, -INT, -OID, -B, and -MISC as indicated on your Baird Consolidated 1099 will be included in the CSV file download. Certain items on the Baird Consolidated 1099 will not download into a CSV file – refer to What information from the Baird Consolidated 1099 will not be downloaded into a CSV file? (Note: if you have multiple accounts at Baird, you will need to download each account separately.)

Return to Top

- If I have multiple accounts at Baird, will I need to download a CSV file for each account?

Yes, you will receive a separate Baird Consolidated 1099 for each reportable account held at Baird. You will need to download multiple CSV files using each separate Account Number and unique Document ID. Remember to save each CSV file to your computer using a unique file name.

- What information from Forms 1099-DIV, -INT and -MISC will be downloaded into a CSV file?

Only the IRS numbered box totals of Forms 1099-DIV, -INT and -MISC of the Baird Consolidated 1099 will be included in the CSV file.

- What information from Forms 1099-B will be downloaded into a CSV file?

Each detailed transaction listed on Forms 1099-B from the Baird Consolidated 1099 will be included in the CSV file including: short-term covered, short-term noncovered, long-term covered, long-term noncovered and undetermined term.

Please carefully review Forms 1099-B for any Undetermined Term transactions (e.g., missing cost basis and/or missing acquisition date) as these items will require manual adjustment to properly reflect on your tax return(s).

Return to Top

- What information from Forms 1099-OID will be downloaded into a CSV file?

The applicable IRS box totals of Forms 1099-OID for each security from the Baird Consolidated 1099 will be included in the CSV file.

- What information from the Baird Consolidated 1099 will not be downloaded into a CSV file?

- Regulated Futures Contracts (e.g., section 1256 contracts) from Form 1099-B boxes 8, 9, 10 and 11 are not supported by the CSV file download.

- Amounts that are designated as “noncovered" or "lots not reported" in the "Original Issue Discount and Adjustments” section on page 2 are not supported by the CSV file download.

- The section designated by "The following amounts are not reported to the IRS" located beneath the 1099-INT on page 2 of the Baird Consolidated 1099 will not be included in the CSV file.

- The section designated by "State tax withheld" located beneath the 1099-INT on page 2 of the Baird Consolidated 1099 will not be included in the CSV file.

- The “Reconciliations, Fees, Expenses and Expenditures” (e.g., interest paid, margin interest, partnership distributions) section on page 2 of the Baird Consolidated 1099 will not be included in the CSV file.

- Form 1099-R and Form 1099-Q will not be included in the CSV download.

The items listed above must be manually entered into tax accounting software as they are not supported in a CSV file download. In addition, any Undetermined Term transactions on Form 1099-B (e.g., missing cost basis and/or missing acquisition date) will not be complete in the CSV file download. Undetermined Term transactions will download partially but will require manual adjustment to be properly reflected on your tax return(s).

The items listed above are not intended to be all inclusive. The Baird Consolidated 1099 is the official 1099 record and you should verify that your federal and/or state tax return(s) include all of the items shown on the Baird Consolidated 1099.

- Will Partnership distributions be downloaded into a CSV file?

No, Partnership distributions will not be included in a CSV file download.

Return to Top

- Will the Baird Form 1099-R or Form 1099-Q be downloaded into a CSV file?

No, Baird does not support the download of Form 1099-R or Form 1099-Q into a CSV file.

- When will the Baird Consolidated 1099 be available to download into a CSV file?

The CSV file for your Baird Consolidated 1099 will be available to download when you receive your Baird Consolidated 1099 via the United States Postal Service (USPS) or your Baird Online account. Generally, the Baird Consolidated 1099 will be mailed: February 15 (for Wave I accounts), March 1 (for Wave II accounts), and March 15 (for Wave III accounts). If applicable, it is important to note that the CSV file download on March 15 will contain the tax-related data for both the Baird Consolidated 1099 and the Baird REMIC/WHFIT Statement combined. See Bairdwealth.com/taxes for additional information regarding the Baird tax document mailing dates.

- If I receive a corrected current tax year Baird Consolidated 1099, will I need to download a new CSV file?

It depends on the tax accounting software being used and how it accommodates corrected tax data. The CSV file download will be updated each time a corrected current tax year Baird Consolidated 1099 is issued. The CSV download is not available for prior tax years. Please refer to the instructions for your specific software program to determine how to process corrected tax data.

Return to Top

- Will the CSV file import into TurboTax®?

No, Baird offers a separate service to import the Baird Consolidated 1099 into TurboTax®. Please review the TurboTax® Import Instructions for information.

- Who should I contact if I have questions with a CSV file download?

You may contact Baird’s 1099 Help Line at 1-888-RWB-1099 option 2.

- Who should I contact if I have questions about importing the CSV file into my professional tax accounting software?

You should contact your specific software program vendor with any questions about importing a CSV file.

- Why is my CSV file not downloading?

If your browser settings have been modified, these changes might cause problems downloading the CSV file. Reset your browser settings to their default settings and try downloading the CSV file again.

Return to Top

It is important to understand that the download of the Baird Consolidated 1099 into a CSV file may not contain all information required for you to properly complete the investment income portion of your federal and/or state tax return(s).

Be sure to verify the information that you download with your own records to ensure accurate and complete reporting of all required tax information on your federal and/or state tax return(s). Although Baird is providing the download of the Baird Consolidated 1099 into a CSV file as an additional service, Baird does not guarantee that the information provided is sufficient for tax reporting purposes, and Baird is not liable for your reliance upon or use of the CSV download service or the data provided through such service. If you have specific questions regarding the preparation of your tax return, contact your tax advisor, the IRS or the state(s) to which you report.

The printed Baird Consolidated 1099 is the official record of Forms 1099 information maintained at Robert W. Baird & Co. Incorporated. Robert W. Baird & Co. Incorporated disclaims any liability arising from the use of the Service, FIS Wall Street Concepts® software and/or the content furnished by or through any third party, including but not limited to, any resulting information obtained from such use, or interpretations of information made as a result of such use.