12 Predictions for European Private Equity Activity in 2025

M&A momentum is building after the return of bigger deals in 2024 – flight to quality remains

- 1) European M&A recovery underway – anticipated acceleration in PE activity likely to be weighted to H2 2025

- 2) Record P2P activity in 2024 – transatlantic large-cap sponsors proactively targeting €1bn+ listed companies

- 3) Robust public and private debt financing markets driving incrementally lower pricing to support M&A activity

- 4) Average LBO valuations returning to pre-Covid levels – multiples ticking up given bias to high quality assets

- 5) UK and DACH to continue leading PE activity – outcome of elections could add to market uncertainty

- 6) PE sector mix settling into a “new normal” – software & technology to continue as the most active sector

- 7) Evolving subsector preferences within each sector – PE firms increasingly selective on where to focus

- 8) US trade buyers remain important, accounting for a third of the strategic buyer activity for European PE exits

- 9) Fundraising environment will remain bifurcated / challenging until DPI recovers from its current low

- 10) Record global continuation vehicle activity in 2024 Europe to follow the US as penetration of CVs increases

- 11) Trump’s trade policies likely to impact some European sale processes, where companies export to the US

- 12) US to lead M&A recovery as economy underpins current trading, driving process launches and completion rates

1) European M&A recovery underway – anticipated acceleration in PE activity likely to be weighted to H2 2025

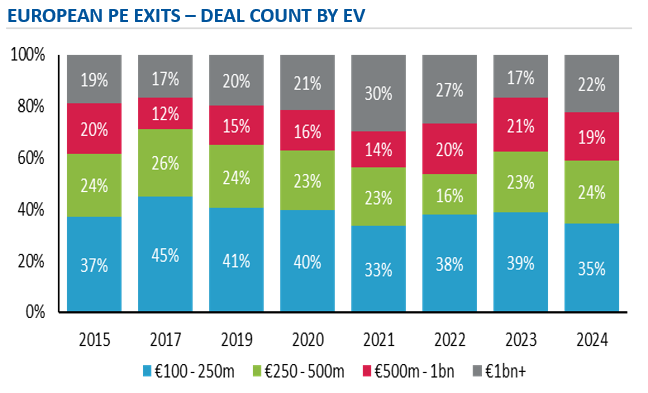

The M&A downturn is behind us. European private equity (PE) buyouts (with €100m+ in enterprise value) recovered from the trough with deal count and value up 5% and 65% respectively in 2024 compared to 2023. Improving debt financing conditions supported larger deals with a record 22% share of buyouts worth over €1bn. European PE exits (with EV €100m+) increased by 105% and exit value by 130% in 2024. While activity is up materially from 2023, it is still below pre-Covid levels, particularly for PE exits. This positive momentum should continue, though we anticipate the acceleration in PE buyout and exit activity to be weighted to the second half of 2025 given:

- Substantial backlogs (mandated M&A pipeline) within investment banks advising on sell-side processes

- Companies wanting valuation credit for their 2025 financial results, whether year-to-date or for the full year

- Uncertainty related to the implementation of tariffs by the Trump administration, potentially including on the EU

“Many European PE firms did not see the M&A recovery they were hoping for in 2024. We are anticipating a stronger 2025 as activity accelerates gradually with deal signings weighted to H2 2025.”

Vinay Ghai

Financial Sponsors Group

Source: Unquote, PE deals with EV (enterprise value) over €100m, PitchBook for P2P data.

2) Record P2P activity in 2024 – transatlantic large-cap sponsors proactively targeting €1bn+ listed companies

2024 saw record public-to-private (P2P) activity in Europe with targets headquartered in the UK, Nordics and DACH accounting for 80%. The relatively low volume of high quality secondary buyout opportunities is driving sponsors to consider more P2P deals and undertake the specific take-private due diligence and process requirements. 54% of P2P deals in 2024 were worth over €1bn, many executed by transatlantic large-cap sponsors such as Blackstone, Brookfield Asset Management, Canada Pension Plan Investment Board, Energy Capital Partners, KKR and Thoma Bravo.

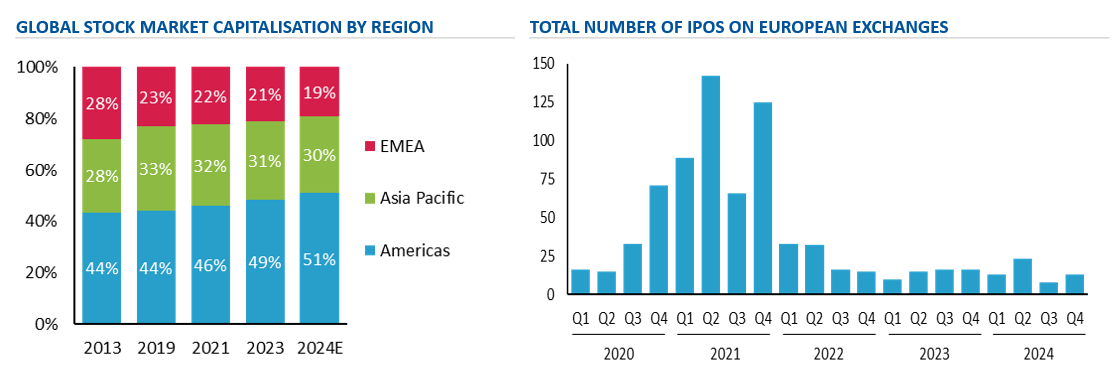

The European public stock markets offered significantly more buying opportunities than PE-backed IPO exits last year. 88 companies delisted (or transferred their primary listing) from the London Stock Exchange in 2024, while there were only 18 IPOs, the lowest in 15 years. The Financial Conduct Authority simplified the UK listings regime last year; however, some UK / European based IPO candidates prefer the depth, liquidity and higher valuation levels of the US stock markets. This could start to change if IPO momentum picks up through a number of successful listings at robust valuation levels on European exchanges in 2025.

“Transatlantic sponsors often see value in listed European companies given the valuation discount compared to listed US peers. The STOXX 600 trades at an average of 11x vs. the S&P 500’s 16x EBITDA.”

Pat Guerin

Co-Head of Global M&A

Source: PitchBook, P2P (public-to-private) deals with EV over €100m.

Source: Statista, Baird estimates. S&P for Europe IPO data, a minority of which are PE backed.

3) Robust public and private debt financing markets driving incrementally lower pricing to support M&A activity

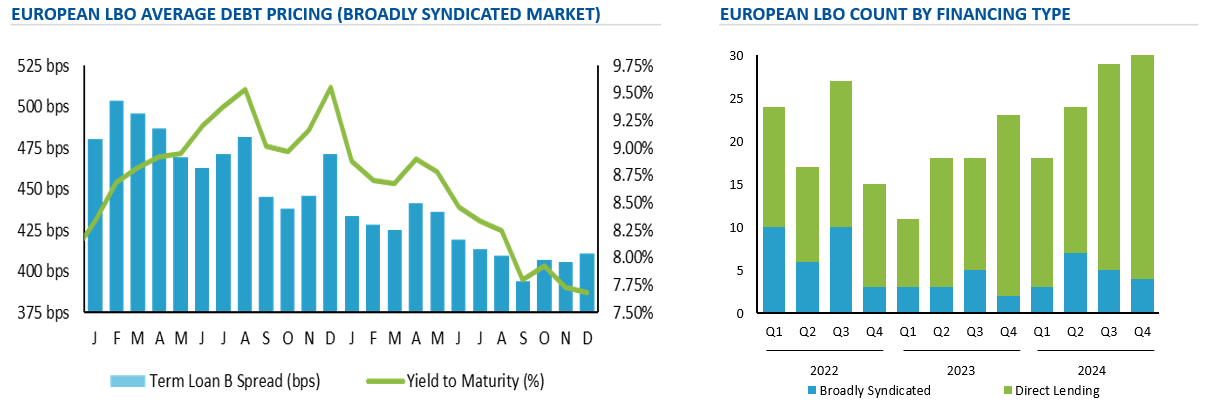

European sponsored leveraged loan volume in the broadly syndicated market reached €84bn in 2024, the second highest since the Great Financial Crisis, largely driven by refinancings and opportunistic repricings. PE firms are also using dividend recaps to provide partial liquidity to LPs to address low DPI (distributions to paid in capital ratio). Pricing pressure prevailed, partly due to the lack of wider M&A opportunities meaning ample dry powder, assisting in holding the average TLB (term loan B) spread at ~400 bps. The 20% share of volume for buyouts in 2024 was the lowest on record for the public debt markets. We expect this share to increase as more M&A processes launch in 2025.

Private markets are equally competitive, with credit funds pricing tight to retain attractiveness against peer funds or bank club alternatives. This continues to be visible in Baird’s European lender education processes where pricing is coming under further pressure, including from US market precedents. What at the start of the year appeared to be a slower pace of central bank rate cuts in the UK vs. Europe has now changed direction, with concerns on economic growth taking greater emphasis than tackling inflation.

While these competitive dynamics mean the very best terms for the highest quality credits, there is also a focus on more challenged credits or those facing debt maturities and how the “capital solutions” market can resolve those issues away from the mainstream.

For Baird’s view on key themes shaping the European debt capital markets in 2025, please click here.

“Bifurcation in appetite will continue in 2025 based on the sector and quality of the credit with some lenders pushing through historic boundaries on both price and structure for the very best assets.”

Andrew Lynn

Head of European Debt Advisory

Source: PitchBook LCD, based on deals covered by LCD News

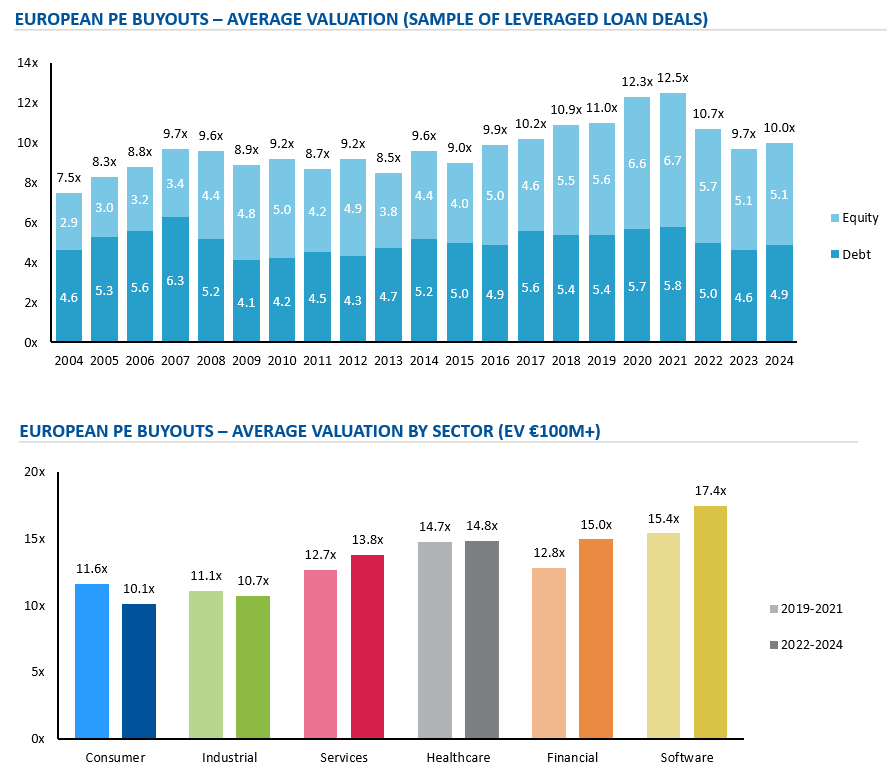

4) Average LBO valuations returning to pre-Covid levels – multiples ticking up given bias to high quality assets

Average LBO valuations edged up to 10x EBITDA in 2024, the same as the pre-Covid average for 2014–2019. The M&A valuation gap between buyers and sellers narrowed in 2024 as valuation expectations and debt financing started to normalise. However, we also saw record bifurcation (for a sample of leveraged loan deals) between the average valuations of secondary buyouts (13x EBITDA) and corporate divestitures (7x EBITDA). Within M&A sale processes, we have observed higher bid dispersion (based on the spread of round 1 bids) in 2022–2024 compared to 2019–2021.

“There is significant bifurcation in valuation. While some sectors are down by a turn (1x EBITDA), other sectors are at 2021 levels. For example, Baird’s software sell-sides in 2024 averaged 20x+ EBITDA.”

Tahs Siddique

M&A Research

Source: PitchBook LCD and Baird estimates showing average EV / EBITDA multiple for a sample of leveraged loan transactions, excluding outliers.

Source: Unquote showing average EV / EBITDA multiple where available. Baird deal by deal analysis for sector allocation.

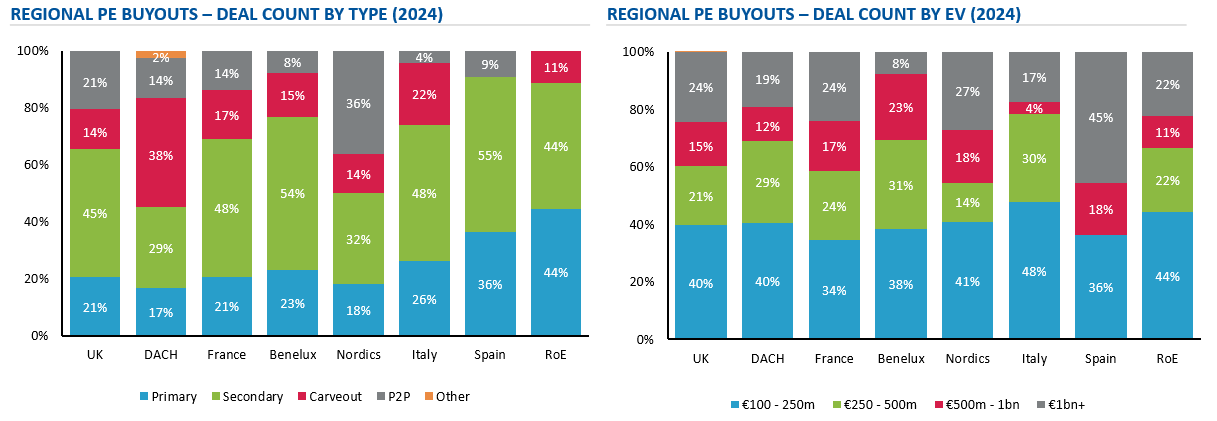

5) UK and DACH to continue leading PE activity – outcome of elections could add to market uncertainty

The UK and DACH proved their resilience through the recent M&A downturn, accounting for a record half of European buyouts. DACH (Germany, Austria, Switzerland) is now the second most active region for buyouts, overtaking France for the first time in the last decade. M&A activity in France has in part been negatively impacted by political instability since its elections in mid-2024 produced a hung parliament and subsequent minority coalition government. We are hopeful that sale processes in Germany are less impacted by the federal election that took place on 23 February 2025.

“Despite the GDP contraction in both Germany and Austria over the last two years, M&A demand and supply in DACH was supported by a quadrupling of buyouts from corporate carveouts in 2024.”

Oliver Meyer

Financial Sponsors Group

Source: Unquote, majority deals EV €100m+.

6) PE sector mix settling into a “new normal” – software & technology to continue as the most active sector

2024 could represent a “new normal” for buyout activity by sector as the share of both consumer and healthcare recovered from their record lows in 2023 and as software & technology became the most active sector. Software is indeed a bright spot for M&A, and we are generally not seeing this level of buyer / seller confidence in other sectors. Baird has achieved a valuation of 6 – 12x+ ARR (annual recurring revenue) for all of our software sell-sides in 2024. Buyers are more data hungry than ever and their due diligence focus when evaluating software M&A targets includes:

- AI (artificial intelligence) opportunity or threat – especially for “content” and “workflow” based businesses

- Differentiation and stickiness – prove price elasticity and margin defensibility

- Specialist vs. platform – share of wallet analysis to quantify whitespace

- Size of TAM (total addressable market), and ability to expand the TAM

- Less leeway on software / SaaS metrics – rule of 40, gross retention of 90%+

- Proof-points on internationalisation – local leaders to evidence momentum elsewhere

- Add-on M&A pipeline – incorporation of M&A in the business plan, targets in pipeline

Many industrial companies are at the end of the destocking driven downcycle after the last three years, which were distorted by a massive demand pull-forward (overstocking) post-Covid given global supply chain issues and inflation. CEOs of publicly listed industrial corporates expect the next industrial cycle will be a more normal demand driven cycle with the recovery starting in 2025. Simplification is driving divestiture activity as industrial corporates reduce cyclicality and align to secular growth themes. We therefore anticipate a modest uptick in industrial M&A in 2025, both from the demand and supply side, which would likely maintain a share of European industrial buyout activity at around 20%.

We also expect services sector activity to remain at around 20% of activity in 2025. Within services, we continue to see a higher proportion of tech-enabled business models and specialist outsourced solutions in relatively high growth areas. These areas include GRC (governance, risk and compliance), outsourced financial services, research & intelligence, energy & sustainability consulting and TICC (testing, inspection, certification and compliance).

We have seen a continued “flight to quality” over the last decade; 2025 will be no different. PE firms have set the bar even higher for companies with any perceived investment risk such as cyclicality, consumer exposure and public sector funding.

“It seems likely that software & technology continues to be the most active sector in 2025, a trend we are seeing in Baird’s own M&A backlog.”

Giles Corner

Financial Sponsors Group

Source: Unquote, majority deals EV €100m+. Baird deal by deal analysis for sector allocation.

7) Evolving subsector preferences within each sector – PE firms increasingly selective on where to focus

PE firms are doing “deep-dives”, choosing which subsectors to focus on and proactively chasing a few targets that fit their quality and size criteria. This has implications for M&A process dynamics and timelines, where some processes are very broad while others are highly targeted comprising a small group of pre-qualified potential buyers. Either way, PE appetite within sectors is changing rapidly and our subsector analysis of European buyouts shows a few trends:

- Increasing PE appetite for beauty & wellness within consumer, particularly VMS (vitamins, minerals, supplements)

- Shift towards technology and sustainability within industrial e.g. electrical equipment, renewable energy equipment

- Sponsors drawn to the defensive contractual nature of FIRE (facility, industrial, residential, environmental) services

- Software accounting for the majority of tech deals since 2019 as PE firms move away from telecoms & equipment

- Decline in healthcare services (businesses with a high labour content) in favour of healthcare IT in recent years

- Continued activity in the financial sector (e.g. insurance broking, IFA / wealth management) where there is a shift away from balance sheet driven business models and in the financial services subsector (e.g. accounting, fund admin, trust & corporate services) with a focus on non-commoditised / specialised service and end market offerings

“While some subsectors are seeing relatively low buyer engagement, market congestion is becoming an M&A process consideration for other subsectors.”

Will Morton

Financial Sponsors Group

Source: Unquote, majority deals EV €100m+. Baird deal by deal analysis for subsector allocation.

Note: FIRE (Facility, Industrial, Rental and Environmental) Services.

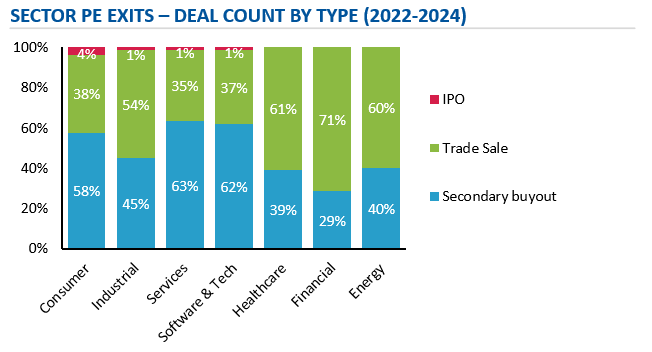

8) US trade buyers remain important, accounting for a third of the strategic buyer activity for European PE exits

In the last three years, 53% of PE exits have been to other financial sponsors, 45% to trade buyers and 2% via IPOs. Trade buyers from the US made up a third of the strategic activity, almost double that of the next most active country (UK). We believe this level of US trade activity will continue in 2025, supported by the strength of US dollar against the Euro and British pound. Most listed US corporates in industrial, software & technology and healthcare sectors benefit from strong public equity market valuations relative to their European counterparts. In many cases, this allows them to approach the European M&A market with a relatively higher baseline valuation and benefit from multiple arbitrage.

Source: Unquote, PE Exits EV €100m+. Baird deal by deal analysis for sector allocation.

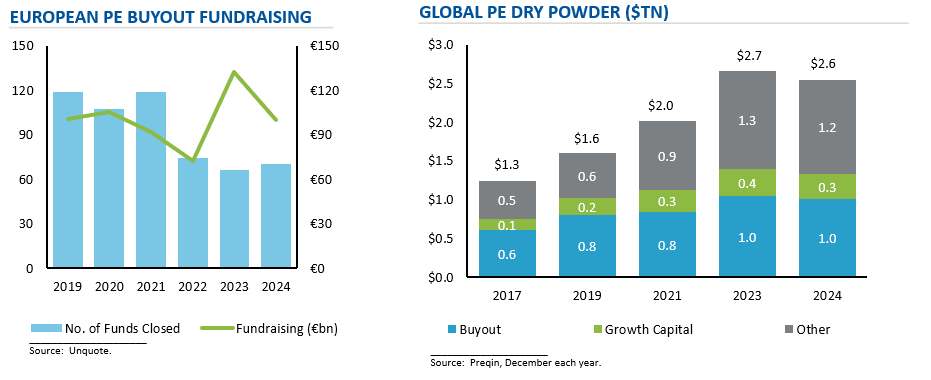

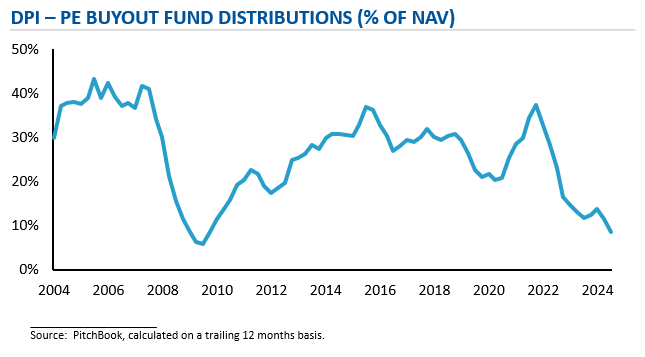

9) Fundraising environment will remain bifurcated / challenging until DPI recovers from its current low

Fundraising volume slowed in 2024 after a strong 2023. €100bn was raised for European based buyout funds in 2024, down 25%. The number of buyout fundraisings fell 40% in the last 3 years compared to 2019 – 2021. The number of new funds coming to market was at a 10 year low and some generalist middle-market funds have been struggling. Globally in 2024, PE firms spent an average of 18 months to hold a final close compared to 9 months in 2019.

This difficult environment, where LPs are concentrating their allocations to the largest and most successful GPs, is changing the sponsor landscape. Some PE firms are in wind-down mode while others have multi-billion dollar funds to deploy. The best performers, including in the mid-market, are still fundraising effectively. We are hopeful that the fundraising environment will improve once DPI (distributions to paid in capital ratio) recovers from its 15 year low.

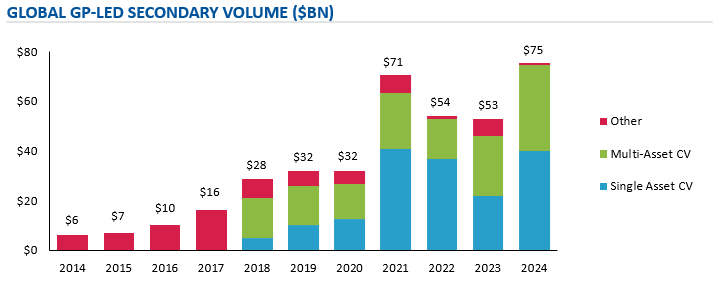

10) Record global continuation vehicle activity in 2024 – Europe to follow the US as penetration of CVs increases

PE firms are holding assets for longer – the median in Europe has risen from 5.2 years in 2021 to 6.1 years in 2024. Elongated portfolio company hold periods and DPI pressure are growing the pipeline for PE M&A exits. We are also seeing more GPs use continuation vehicles (CV) to provide liquidity for LPs, grow assets under management and retain high quality assets in the “portfolio”. This was proven by record GP-led secondary activity in 2024.

2025 could be even higher as we believe the market is still in the early stages of using these vehicles to proactively manage PE portfolios and drive optimised outcomes. Some European GPs have done a handful of CVs, but most are on the learning curve with limited experience with this type of transaction technology. Baird estimates that CVs accounted for 12% of PE distributions in 2024, up from 2% in 2018, led by the US.

For Baird’s report on “navigating the nuances of continuation vehicles”, please click here.

Source: Pitchbook, Baird Estimates.

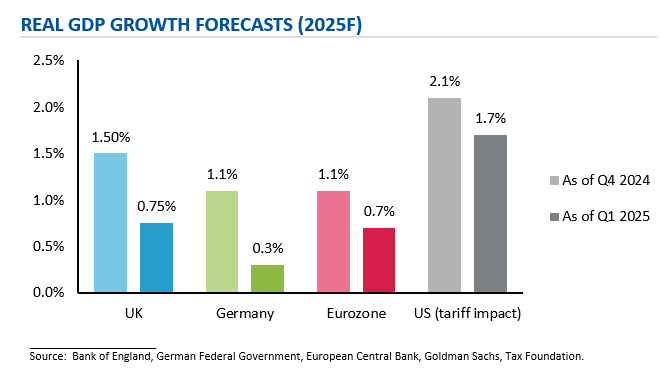

11) Trump’s trade policies likely to impact some European sale processes, where companies export to the US

As of February 2025, Donald Trump has applied a 10% additional tariff on imports from China to the US and has temporarily delayed the implementation of a 25% tariff on imports from Canada and Mexico. He suggested that imports from the European Union (EU) to the US could also be subject to a 10% tariff. Furthermore, President Trump effected a 25% tariff on steel and aluminium imports into the US from March 2025. While some economists have forecasted US GDP growth in 2025 to be 40 basis points lower due to the impact of tariffs, GDP forecasts for the UK, Germany and Eurozone have already been reduced for other reasons (does not include impact of tariffs by the US on the EU).

Whether or not tariffs on the EU, Canada or Mexico are instigated, the uncertainty is already impacting capital expenditure plans and M&A activity of corporates and PE firms alike. We expect heightened risk aversion and due diligence from potential buyers evaluating European headquartered companies, particularly in the consumer and industrial sectors, that export products to the US from manufacturing plants or supply chains in the EU, Canada, Mexico and / or China. The Trump administration is currently planning reciprocal tariffs on every country that taxes US imports.

Large multinational corporates, operating with multiple facilities in different regions, have flexibility to move certain production across their facilities to lower the impact of tariffs. This strategy to “produce in a region for that region” is often not an option for mid-market companies with manufacturing plants only in Europe. In 2025, we envisage more PE portfolio companies proactively target add-on acquisitions in the US to access the local US market and supply chains, creating global platforms and bypassing tariffs.

12) US to lead M&A recovery as economy underpins current trading, driving process launches and completion rates

At the start of last year, we predicted that 2024 could see a broad M&A recovery (not just “A grade” assets) if there was significant improvement across macroeconomic factors such as inflation, interest rates, consumer spending and productivity of the supply chain. While all of these indicators did improve, the financial performance of many European companies continues to be mixed due to a fragile underlying economy, especially when compared to the US. As a result, sale processes are on average taking longer (from start to finish) and completion rates are lower than pre-Covid.

In 2025, we look to the US market to see if a broader set of sale processes launch and successfully transact in the M&A market. Like the European market, US PE activity is up from 2023, but remains below prior levels. The number of US buyouts was up 25% in 2024 compared to 5% in Europe, following previous M&A upcycles, where Europe lags the US by 3 to 6 months. We are hopeful that M&A deal signings, whether as a result of a structured sale process or a bilateral negotiation, in both regions tick up, driven by:

- A more “risk-on” approach from strategic and sponsor buyers

- Record cash on corporate balance sheets and PE dry powder

- Robust public and private debt financing markets with competitive pricing

- Closer alignment of valuation expectations between buyers and sellers

- Accelerating M&A supply from founders, corporate carveouts and PE exits

For Baird’s perspectives on the global M&A outlook in 2025, please click here.