Industrial ECM Year-End Update & Outlook

Baird’s Industrial Equity Capital Markets team reflects on key equity issuance themes and market trends in 2024 and implications for the market in 2025. Baird’s top leaders share their perspectives on new issuance expectations, PE-backed activity and outlook for next year below.

Looking Back on 2024

Active money managers continue to rely on Baird’s 12 Industrial research analysts, covering over 220 stocks, to help with alpha generation. Also, our Industrial ECM business has been a contributor to strong performance as Baird's Industrial bookrun deals have outperformed other Industrial equity offerings by more than 2x this year.

Jon Langenfeld, Head of Global Equities

Investors are testing the quality and readiness of management teams along with durability of the business relative to public alternatives. It’s a great opportunity for private companies and their sponsors to collect feedback from some of the largest public Institutional money managers participating in the premier Industrial conference. Investors also benefit from early exposure to relevant companies in their coverage universe, better understanding of market trends and competitive landscape and opportunity to build a track record with the company. No company should be a surprise or unknown at the time of the IPO launch.

Justin Holsen, Managing Director, Industrial Equity Capital Markets

2025 Outlook: Baird Leadership Soundbites

Joe Packee and Mike Lindemann

Co-Heads of Global Industrial Investment Banking

“Our industrial clients, along with their PE owners, have shown strong interest in the public exit alternative, particularly those with substantial size and scale ($300M+ EBITDA). These clients have consistently met or exceeded performance expectations, reinforcing the IPO appeal. We also have several large clients strategically positioned in high-growth sectors, including data centers, electrical grid infrastructure, energy transition, automation and defense technology. These clients recognize the market premiums awarded to public peers and view public listings as an avenue to access capital for organic growth and M&A opportunities.”

Justin Holsen

Managing Director, Industrial Equity Capital Markets

“Building off successful transactions in 2024, a healthy market backdrop and comparable valuations, we’ve seen a significant increase in conversations and preparation for offerings in the next two years. The dual track is no longer just a threat of going public but will be a reality for many clients in the coming quarters. We expect sponsors to take advantage of open market windows sooner rather than later, knowing that ultimate liquidity will come 2-3 years post IPO and will benefit from strong company performance in the public domain.”

Jason Trennert

Chairman & CEO, Strategas

“We’re hearing more excitement about the prospects for deregulation and the productivity gains associated with the newly-formed DOGE than there is fear about tariffs. We expect a marked increase in deal activity and capital investment in 2025. This, in our view, will more than offset a decline in government deficit spending.”

Jon Langenfeld

Head of Global Equities

“Our buyside clients have expressed significant appetite for IPOs and follow-ons in 2025, and are preparing to deploy significant capital to generate excess returns, whether it's providing growth capital or liquidity to existing holders.”

Joe Packee and Mike Lindemann

Co-Heads of Global Industrial Investment Banking

“Our industrial clients, along with their PE owners, have shown strong interest in the public exit alternative, particularly those with substantial size and scale ($300M+ EBITDA). These clients have consistently met or exceeded performance expectations, reinforcing the IPO appeal. We also have several large clients strategically positioned in high-growth sectors, including data centers, electrical grid infrastructure, energy transition, automation and defense technology. These clients recognize the market premiums awarded to public peers and view public listings as an avenue to access capital for organic growth and M&A opportunities.”

Justin Holsen

Managing Director, Industrial Equity Capital Markets

“Building off successful transactions in 2024, a healthy market backdrop and comparable valuations, we’ve seen a significant increase in conversations and preparation for offerings in the next two years. The dual track is no longer just a threat of going public but will be a reality for many clients in the coming quarters. We expect sponsors to take advantage of open market windows sooner rather than later, knowing that ultimate liquidity will come 2-3 years post IPO and will benefit from strong company performance in the public domain.”

Jason Trennert

Chairman & CEO, Strategas

“We’re hearing more excitement about the prospects for deregulation and the productivity gains associated with the newly-formed DOGE than there is fear about tariffs. We expect a marked increase in deal activity and capital investment in 2025. This, in our view, will more than offset a decline in government deficit spending.”

Jon Langenfeld

Head of Global Equities

“Our buyside clients have expressed significant appetite for IPOs and follow-ons in 2025, and are preparing to deploy significant capital to generate excess returns, whether it's providing growth capital or liquidity to existing holders.”

Joe Packee and Mike Lindemann

Co-Heads of Global Industrial Investment Banking

“Our industrial clients, along with their PE owners, have shown strong interest in the public exit alternative, particularly those with substantial size and scale ($300M+ EBITDA). These clients have consistently met or exceeded performance expectations, reinforcing the IPO appeal. We also have several large clients strategically positioned in high-growth sectors, including data centers, electrical grid infrastructure, energy transition, automation and defense technology. These clients recognize the market premiums awarded to public peers and view public listings as an avenue to access capital for organic growth and M&A opportunities.”

Justin Holsen

Managing Director, Industrial Equity Capital Markets

“Building off successful transactions in 2024, a healthy market backdrop and comparable valuations, we’ve seen a significant increase in conversations and preparation for offerings in the next two years. The dual track is no longer just a threat of going public but will be a reality for many clients in the coming quarters. We expect sponsors to take advantage of open market windows sooner rather than later, knowing that ultimate liquidity will come 2-3 years post IPO and will benefit from strong company performance in the public domain.”

2024 Baird Industrial ECM Highlights

Bookrunner on ~70% of Industrial transactions in 2024

>$5B in Capital Raised

~50% of transactions were secondary

22% Median Offer-to-Current for Baird bookrun deals1

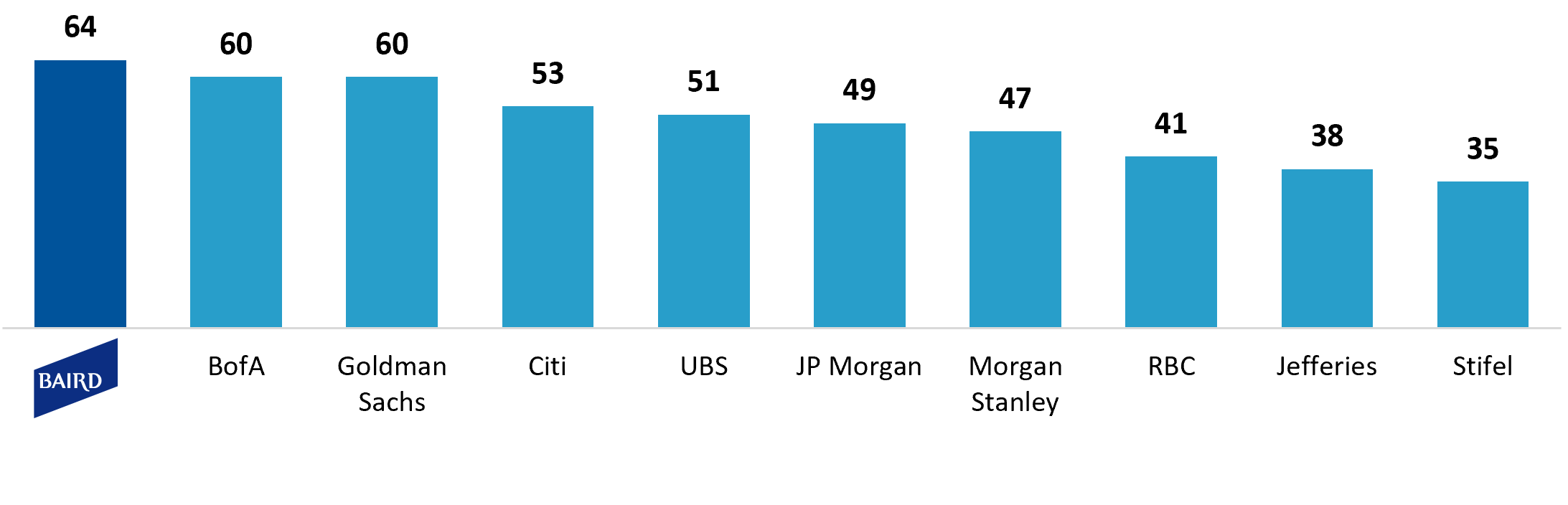

Leading Equity Underwriting Franchise Since 20182

Select 2024 Baird Industrial Transactions

1As of December 13, 2024

2Dealogic Industrial offerings as of December 13, 2024. Excludes ADRs, closed-end funds, SPACs, deals less than $15 million, Mining and Metal & Steel issuers and bought deals.