CEO Insights: All Lanes Open in Traffic Management

Baird Global Investment Banking recently connected with traffic management industry leaders at our annual Traffic Management CEO Summit in Chicago. Attendees enjoyed compelling industry discussions, lead by Baird, including an M&A market update and a look at recent traffic management M&A activity. Additionally, the Boston Consulting Group provided perspectives on the sector, and Stategas shared its views on the broader economic backdrop. In closing, industry leaders shared perspectives on current market dynamics and their outlook for near-term activity in the traffic management space.

2024 Traffic Management CEO Summit Takeaways

M&A Picking Up Speed

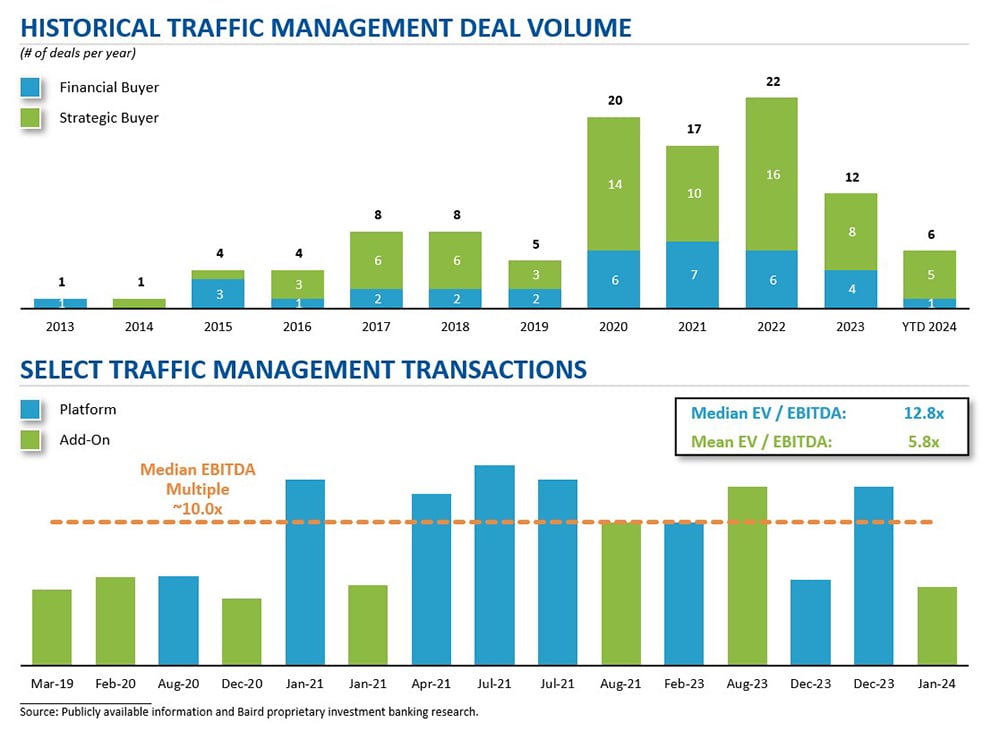

M&A markets have shown a meaningful recovery as transaction volumes have stabilized and large deal activity (i.e., $1B+ TEV) has increased. The traffic management industry has matured – platforms are trading hands between sponsors, and mega funds and infrastructure funds are taking notice of the industry. In addition, more new platforms have been formed as privately owned businesses receive their first institutional capital. Platforms are trading well into the double-digit multiples while add-ons are trading at single-digit multiples; however, competition for add-ons has become fierce with valuations rising for higher-quality businesses.

Project Growth Continues to Rev Up

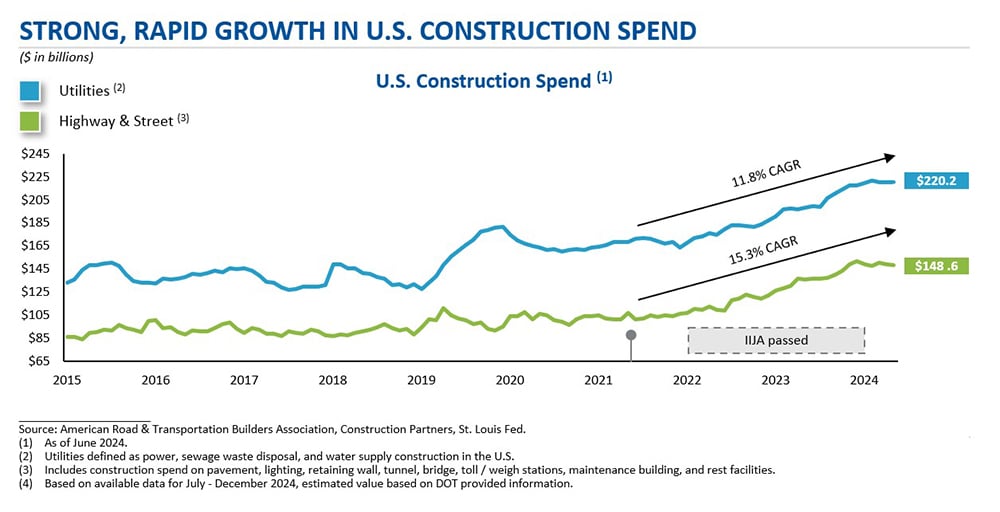

Construction spend on U.S. roads, bridges and utility infrastructure continues to grow necessitating the need for more traffic management services. Outsourcing continues as the work of traffic management companies is seen as mission-critical to completing important infrastructure projects (i.e., building and repair of roads, bridges and utilities) and comes at a relatively low cost to the overall project. The extensive network of existing roads, bridges and utility infrastructure drives a high degree of maintenance work, which is highly reoccurring.

Labor Market Show Signs of Improvement but Remains Congested

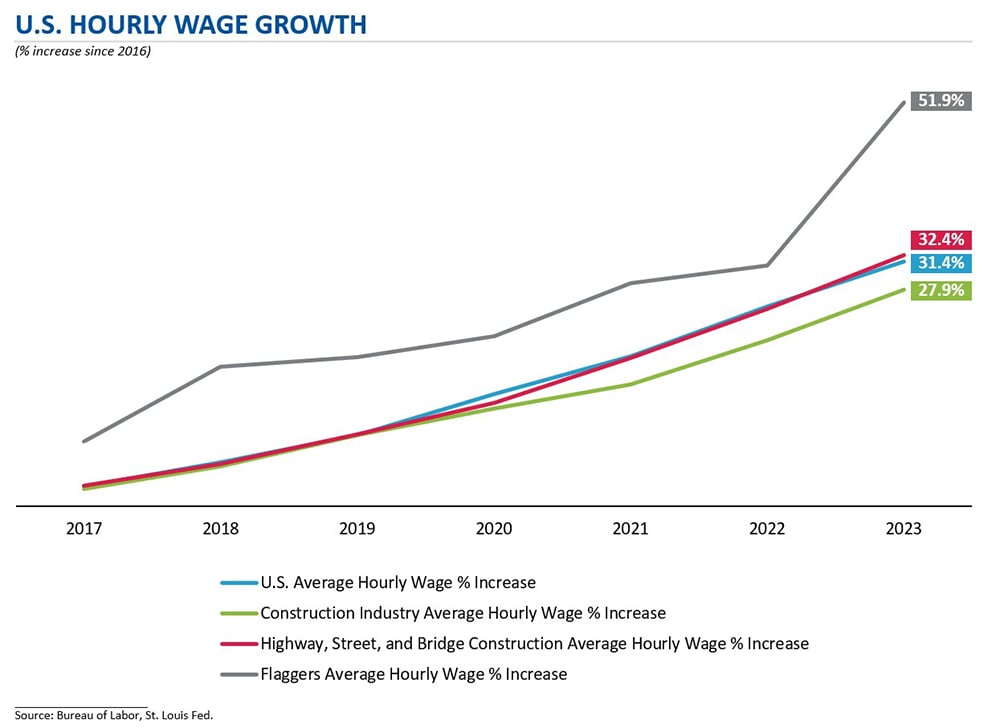

Acquisition of talent has improved but companies still face the challenge of retaining talent. Companies are utilizing customized software and recruiters for difficult-to-hire roles and bulking up internal recruiting resources to meet labor needs and maintain necessary staffing levels. Further, hourly wages for the industry have outpaced U.S. averages – a sign that high demand for and a shortage of available flaggers continues to put pressure on industry wages.

Technology Takes Its Place in the Work Zone

The use of technology in the field has many use cases and purposes. It is seen as complementary to the labor in the field, not as a disruptor. Technology as it currently exists is not seen as a great substitute for labor or human touch in an industry that is reliant on strong customer relationships, interaction with communities served and being nimble enough to function in dynamic work zones. Technology’s value proposition rests on improved safety and operations and less on cost savings, as it’s not believed there will be material labor savings because technology is not resulting in fewer people in the field.

Technology adoption varies by solutions offering – for example, connected message boards have been widely adopted while Automated Flagger Assistance Devices (AFADs) have not. AFADs still require broader state adoption before they hit critical mass, but they are deployed in a small number by service providers. Further, it is believed that AFADs will not completely replace the people in the field that are critical to service delivery. This is especially true for certain end markets (e.g., utilities) that will find it even more challenging to implement AFADs. AFADs still require people for operations and set up, particularly in remote locations and along utility lines under repair.

International Expansion: More Companies Making the Trip

International businesses are entering North America with more regularity, as the North American market expands their addressable market and shares market dynamics of their home countries. The U.S. represents a large whitespace opportunity given it is highly fragmented and a ~$12B market that is growing ~4.5% annually and fueled by growing infrastructure need. Since 2020, there have been approximately 20 entities formed across North America by international businesses either through M&A or greenfield.

Baird’s Facility, Industrial, Residential & Environmental Services (FIRE) practice covers a vast array of critical non-deferrable services, including Traffic Management. Connect with our team to learn more.