Big Deals are Back – 10 Predictions for European PE

Optimistic outlook for the next 12 months as M&A activity recovers from 2023 trough and valuation levels normalise

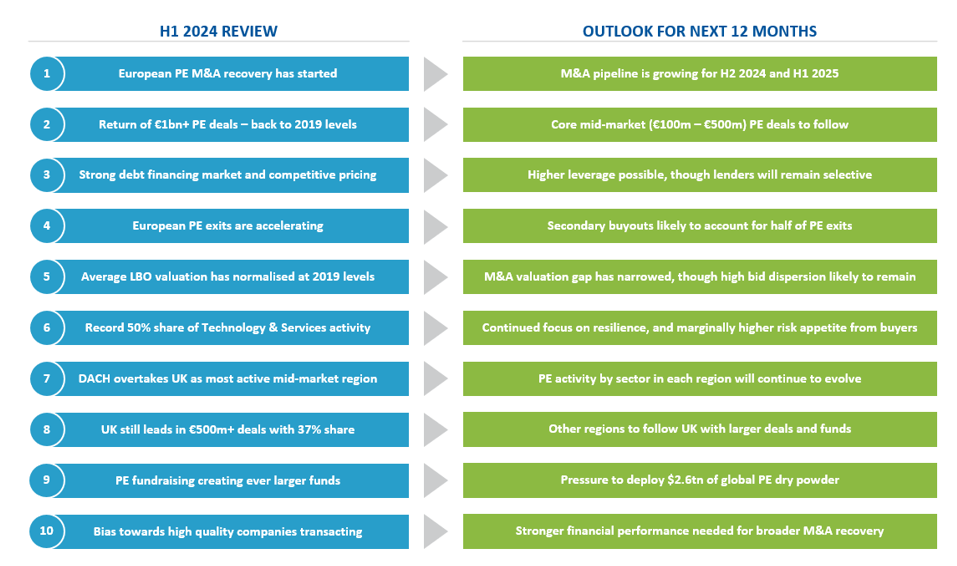

1) European PE M&A recovery has started

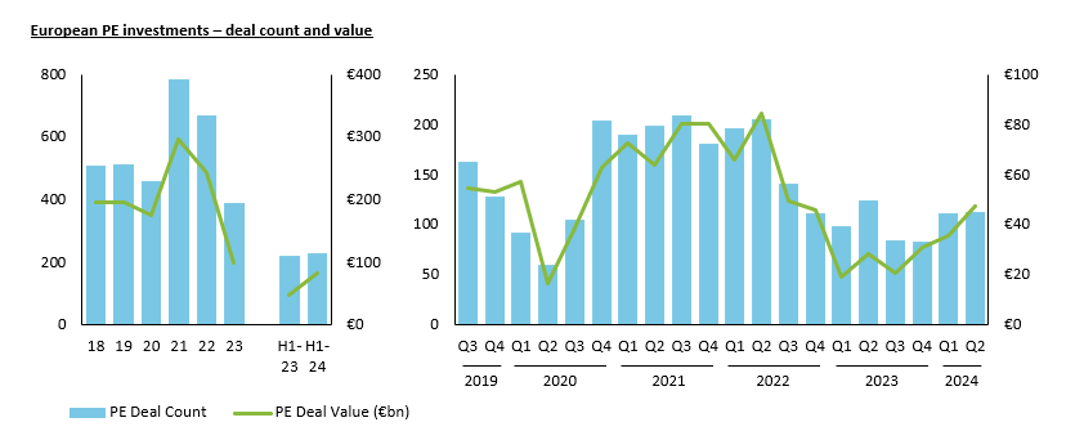

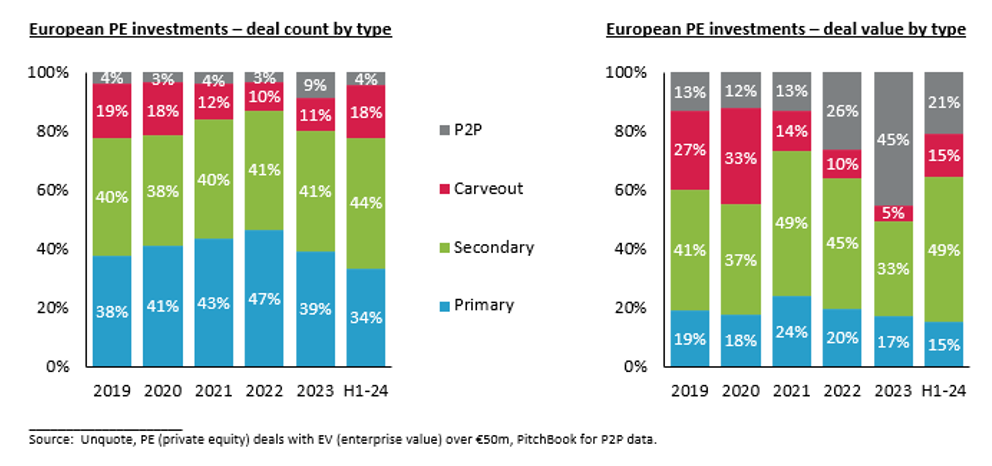

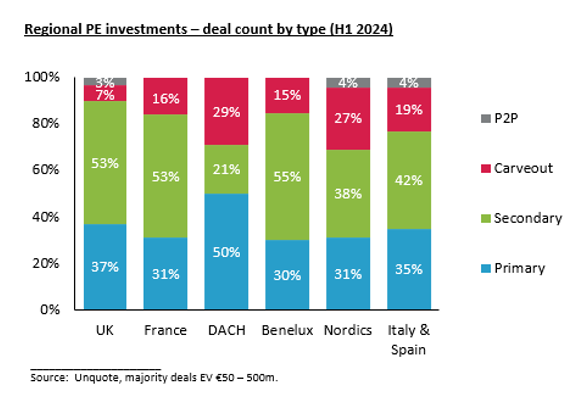

European private equity (PE) activity (for investments over €50m in enterprise value) is recovering from its trough in 2023 with deal count and value up 5% and 75% respectively in H1 2024 compared to H1 2023. However, this M&A recovery is not yet broad based – it is driven by an uptick of secondary buyouts in the upper mid-market with a bias towards high quality “A grade” assets. PE firms reengaged in acquiring corporate carveouts and continued to do opportunistic public-to-private (P2P) transactions, while the proportion of primary deals fell significantly in H1 2024.

The deal pipeline has been growing as PE firms, corporates and private owners take a more positive view on the M&A environment, mandating investment banks on sell-side processes in 2024. We therefore expect to see more PE deal announcements over the next twelve months (H2 2024 and H1 2025) as these businesses come to market. The question is whether we will see a broad based M&A recovery where deal count, not just deal value, materially increases. For this to happen, we would need a wave of “B grade” assets to successfully transact in the M&A market.

2) Return of €1bn+ PE deals – back to 2019 levels

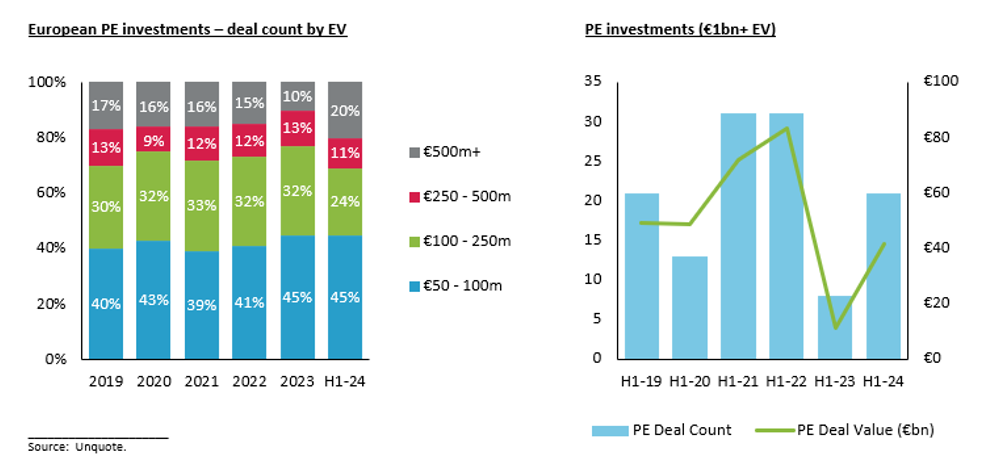

There were over 20 European €1bn+ PE deals in H1 2024, the same as H1 2019, supported by a marked improvement in private and public debt markets and associated pricing. In the upper mid-market, the share of deals with an EV over €500m, doubled to 20%, a new record. CVC alone made a handful of PE investments above €750m in H1 2024.

PE deal count was flat in H1 2024 due to an atypical decline in the number of buyouts in the €100m – €250m EV range, accounting for a record low share of 24%. An acceleration of €1bn+ deals has been a precursor to a broad based M&A recovery in prior M&A cycles. We therefore expect an increase in core mid-market PE deals over the next 12 months.

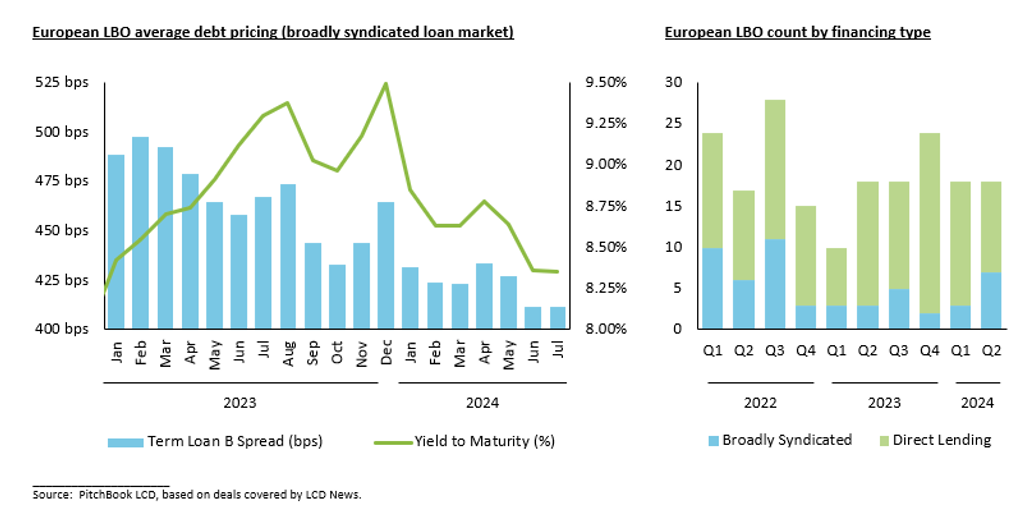

3) Strong debt financing market and competitive pricing

European public market debt volume reached €121bn in H1 2024, 50% and 35% higher than the full year volumes for 2022 and 2023 respectively. Robust appetite and competition (including from the private debt market) have driven the average margin (term loan B spread) for LBOs in the broadly syndicated market down to 400 bps in mid-2024.

In the European private debt market, traditional banks and debt funds are relatively busy as a significant number of sell-side M&A mandates work their way through the lender education process. Activity is increasing across all regions and some lenders have noted that their investment committees are evaluating opportunities across a range of sectors in 2024, in contrast to 2023 where only certain sectors were targeted.

For Baird’s lender education processes as part of our European sell-side M&A mandates, the proportion of lenders providing debt indications and terms has increased in H1 2024 relative to 2023. However, bifurcation remains between sectors with a high degree of leverage and price dispersion based on the perceived quality of the credit. Some of our lender education processes in H1 2024 saw competitive terms not seen since 2021, with debt funds offering 6x EBITDA at below 600 bps margin for high quality assets in resilient sectors.

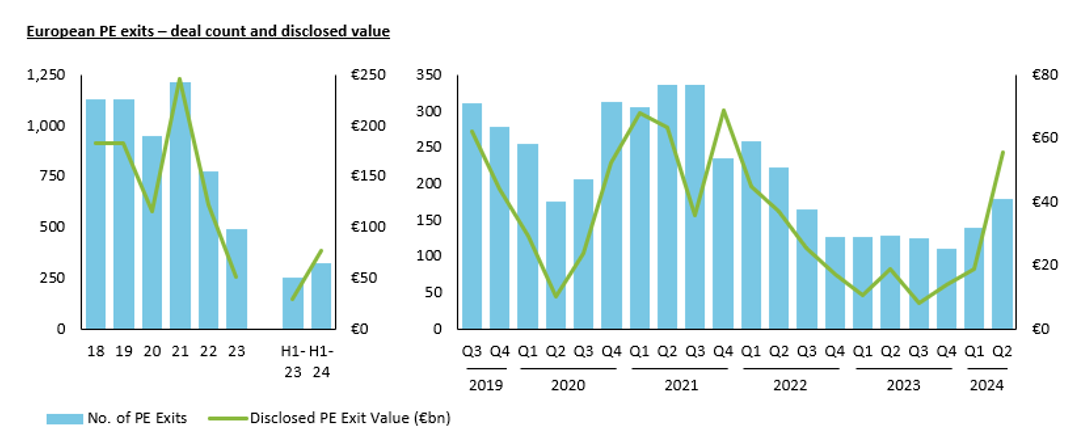

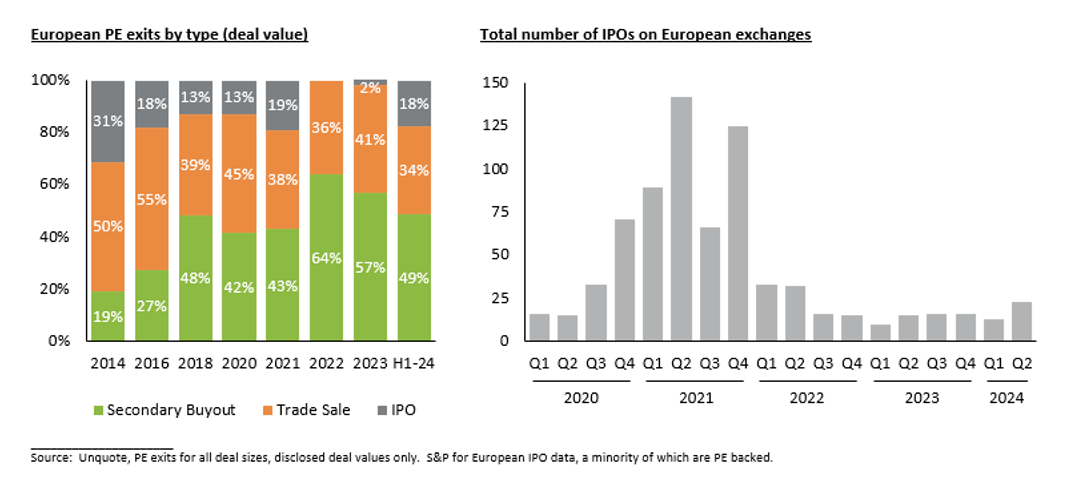

4) European PE exits are accelerating

Private equity exit activity of portfolio companies (for all deal sizes) is on a recovery path with deal count and disclosed deal value up 25% and 150% respectively compared to H1 2023. The mix of European PE exit value by type has normalised in H1 2024 with the reopening of the IPO market and robust appetite from strategic buyers, particularly publicly listed US based corporates and PE backed buy-and-build platforms.

Like previous cycles, PE exit activity is showing a more significant swing between peak and trough on a relative basis compared to PE investment activity. When M&A market conditions deteriorate, PE firms are the first to pause sale processes that have yet to launch (as we saw in H1 2022) and when M&A conditions improve, they are the first to consider exit options for their relevant portfolio companies (as we have seen in H1 2024).

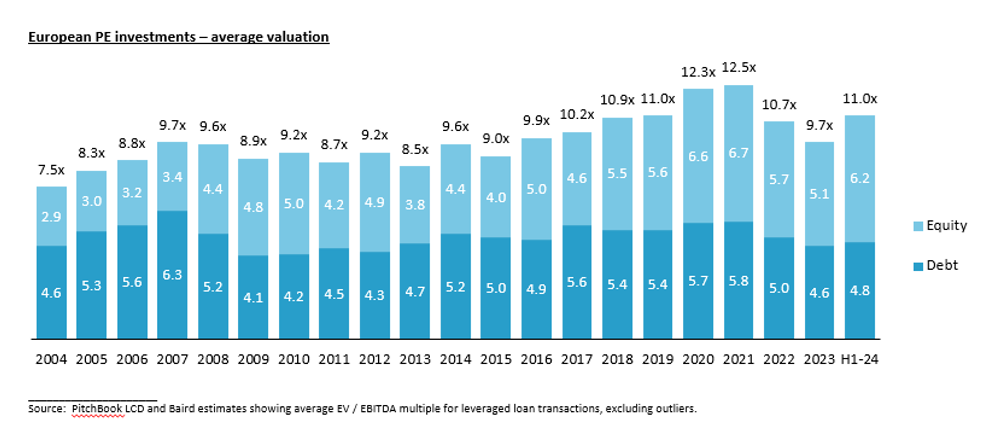

5) Average LBO valuation has normalised at 2019 levels

The average LBO valuation of 11x EBITDA in H1 2024 appears to have normalised at 2019 levels, despite the higher overall cost of debt financing today compared to five years ago. Strong public equity markets have helped support valuations in the private M&A market. However, we are not in a “normal” M&A market where the average reflects companies with a broad variation of quality. We are in an M&A market where there is a significant bias towards high quality companies transacting, where the M&A valuation gap between seller and buyer expectations has narrowed and where bid dispersion (based on the spread of round 1 bids) in the last 18 months has been high relative to 2019 levels.

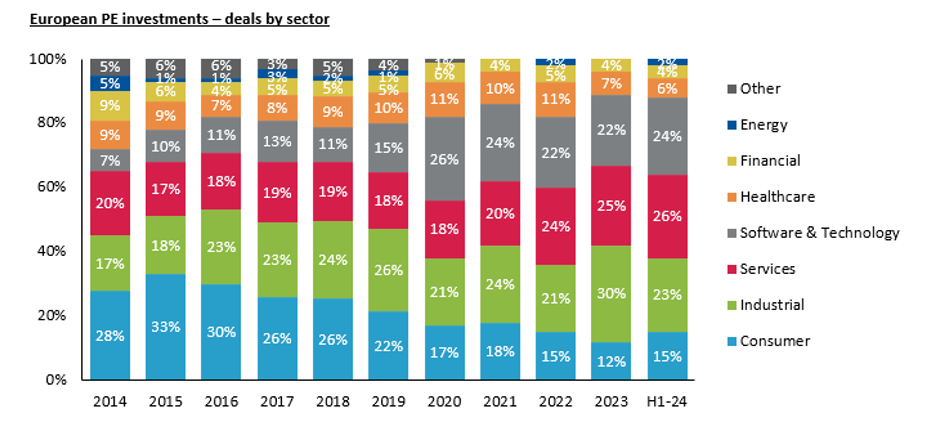

6) Record 50% share of Technology & Services activity

The Software & Technology and Services sectors accounted for half of European mid-market PE investment activity in H1 2024, a new record high. This was driven by M&A demand and supply that are both skewed towards high quality assets in resilient subsectors demonstrating growth such as governance, risk & compliance (GRC) and enterprise content management (ECM). Indeed, Baird’s recently announced advisory transactions of profitable (or near breakeven) “A grade” software companies transacted at valuations of 6 – 12x annual recurring revenue (ARR).

Industrial sector activity normalised to 23% of PE activity in H1 2024 after a record high of 30% in 2023, largely due to a weakening demand environment across various end markets, including some defensive subsectors such as packaging. The share of Industrial secondary buyouts fell accordingly in H1 2024, though was partially offset by an uptick of Industrial M&A supply from corporate divestitures. PE firms often struggle to compete for high quality Industrial assets where strategic buyers, both publicly listed corporates and sizeable PE backed consolidators, have synergies.

Healthcare activity remained muted with primary deals accounting for half of mid-market PE investments. Given Healthcare enjoyed some of the highest valuations at the peak of the M&A cycle in 2021 and H1 2022, PE owners have been reluctant to exit portfolio companies at a lower multiple in the last 24 months, resulting in only a few secondary buyouts in H1 2024. However, we are seeing this dynamic change, for example in pharma services and medical technology as inventory levels and production / sales cycles normalise after the post-Covid supply chain disruption.

Consumer M&A is now recovering after its trough in 2023 when it represented a record low 12% of European mid-market PE activity. However, this recovery was not consistent across regions with no mid-market Consumer PE investments in the UK and only a 5% share in France in H1 2024. The Consumer sector might not return to its pre-Covid share of activity (20%+) in 2025, but we have seen Consumer focused PE firms hone their ability to identify resilient companies in certain “premium” categories that benefit from secular growth themes.

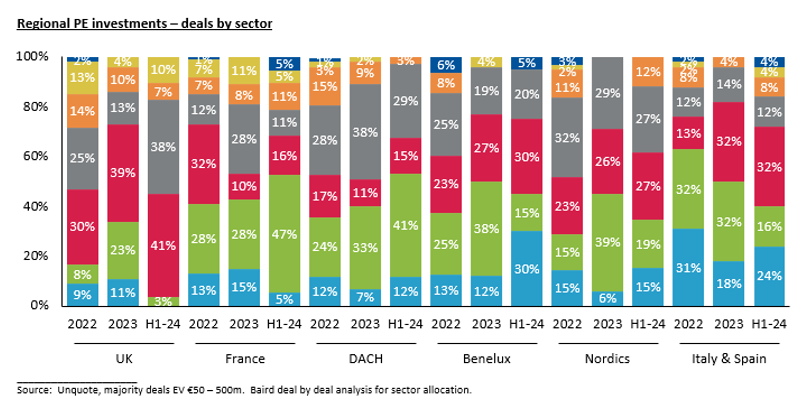

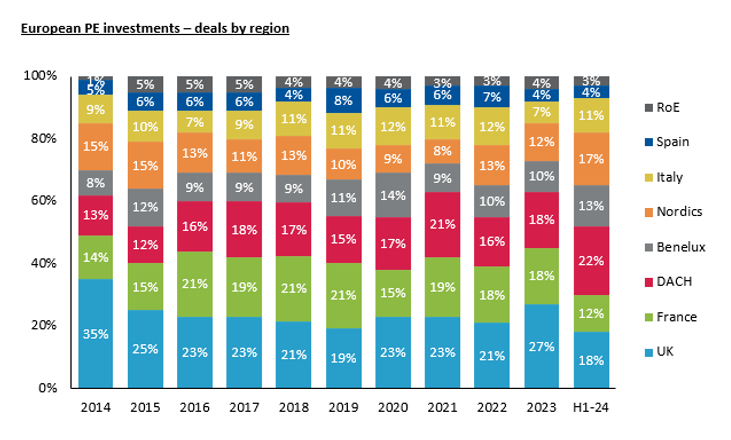

7) DACH overtakes UK as most active mid-market region

For the first time, DACH is the most active region for mid-market PE investments in Europe, overtaking the UK in H1 2024. Private equity has previously struggled to convince longstanding family owned Mittelstand companies to sell to PE firms. However, this has changed in recent years as the next generation of family members are often familiar with the benefits of external investment and are more willing to sell their company to focus on other endeavours. Numerous founder owned DACH companies, typically in Software & Technology, are looking to partner with PE firms as they want to professionalise and internationalise their business to systematically accelerate revenue growth in a profitable way. These dynamics have supported a pole position for DACH, the region with the highest share (50%) of primary buyouts.

The election and consequent political uncertainty have likely delayed the launch of a number of M&A mandates in France, which has fallen from second to fifth place as a region in Europe for mid-market PE investments. On the other hand, the Nordics rebounded posting a record 17% share of activity with corporate divestitures adding to M&A supply. UK, France and Benelux have significant PE penetration with secondary buyouts representing the majority of buyouts.

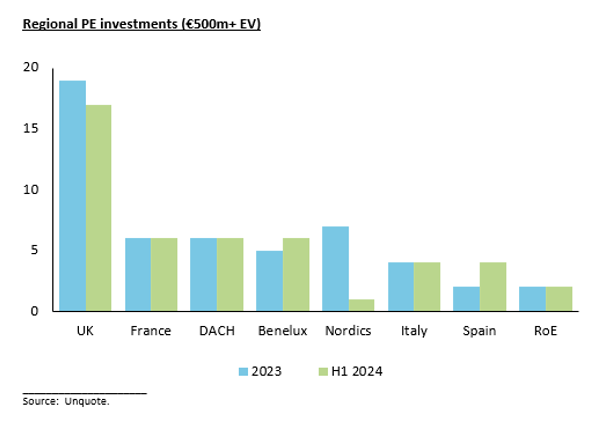

8) UK still leads in €500m+ deals with 37% share

All regions, except the Nordics, saw the number of €500m+ EV deals stay flat or increase in H1 2024 compared to the whole of 2023. This was driven by the reopening of the syndicated loan market, liquidity in the private debt markets and an uptick in PE exits. The UK continued to be ahead of the other regions by a substantial margin with most of the deals being secondary (or tertiary) buyouts in the Software & Technology and Services sectors.

Founders and management teams have shown a preference to keep their businesses privately held for longer, often partnering with private equity. As such, the number of publicly listed companies in Europe (and North America) has decreased over the last 15 years, while the number of PE portfolio companies has grown significantly. We therefore expect the trend of larger secondary buyouts to spread across Europe in the medium term.

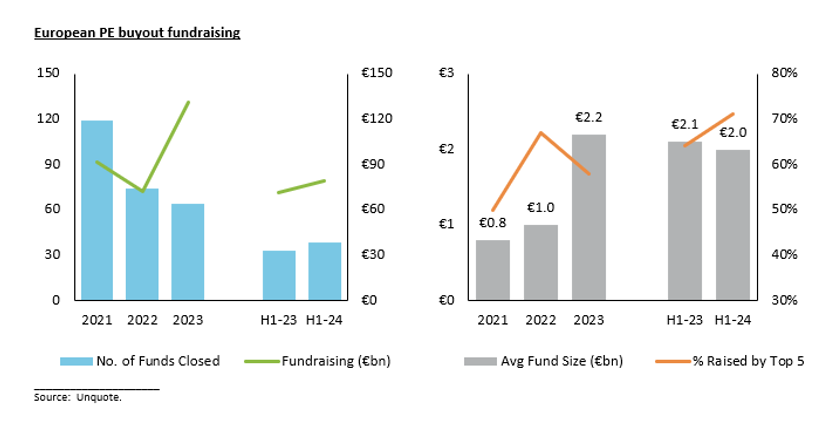

9) PE fundraising creating ever larger funds

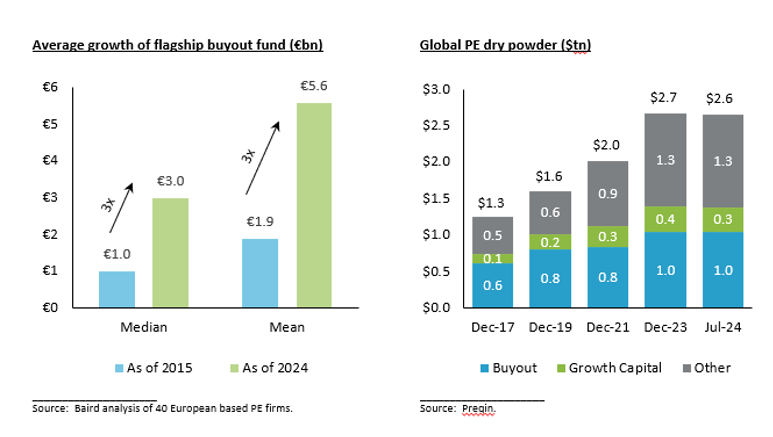

LPs have focused their commitments on larger well-established GPs with a strong track record, doubling the average fund size raised in Europe from €1bn in 2022 to over €2bn in the last 18 months. In total, a robust €80bn was raised for European based buyout funds in H1 2024, a record 70% of which went to the top 5 fundraising GPs – EQT X (€22bn), Partners Group Direct Equity V (€15bn), Cinven VIII (€12.2bn), Bridgepoint Europe VII (€7bn) and Astorg VIII (€4.4bn).

A Baird analysis of 40 European based PE firms showed that the median of their latest flagship buyout fund tripled from €1bn to €3bn over the last 9 years. Some PE firms have grown out of the lower mid-market and into the upper mid-market, and have now raised a “growth fund” to address the deal size that their flagship fund used to a decade ago. Despite this, the environment has been challenging with most PE firms taking longer to raise their latest flagship fund. Globally in H1 2024, PE firms spent an average of 18 months to hold a final close compared to 9 months in 2019.

H2 2024 and 2025 will see pressure to deploy $2.6tn of global PE dry powder, of which $1tn is for buyout investments. Multi-regional focused funds accounted for a record high 42% of the global PE capital raised in H1 2024, more than any of the three individual regions (North America, Europe, Asia Pacific). We see significant cross-border activity for European M&A targets from strategic buyers and PE firms. For example, North American headquartered PE firms accounted for half of European buyouts over €500m in the last 18 months.

10) Bias towards high quality assets transacting

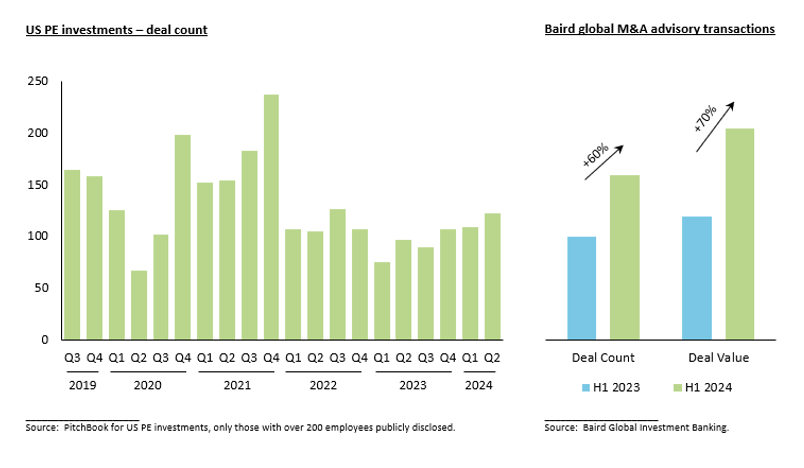

At the start of the year, we predicted that 2024 could see a broad M&A recovery if there was significant improvement across macroeconomic factors such as inflation, interest rates, consumer spending and productivity of the supply chain. Half way through the year, sentiment continues to be mixed. Inflation and interest rates have stabilised, but consumers are feeling the impact of higher prices and mortgage repayments. Eurozone manufacturing PMI (purchasing managers index) of 45.6 in July 2024 is at a seven month low, with a figure below 50 reflecting contraction.

We have thus seen a bias towards high quality assets with robust financial performance. Baird Global Investment Banking has seen an upturn in such PE exits from increased sell-side M&A pitch activity over the last 9 months, leading to growth in our engaged backlog and additional process launches. Our global M&A advisory business saw announced deal count and value increase over 60% and 70% respectively in H1 2024, initially led by the US and more recently Europe. This follows previous M&A upcycles, where increasing European M&A activity lags the US by 3 to 6 months.

The mixed macro environment is impacting individual company performance. Given the need to demonstrate robust current trading in an M&A process, many companies are waiting for better financial results before starting a sale process. 2024 is likely to be a year that delivers a “clean” set of financial figures for these companies after the impact of Covid in 2020 and 2021, supply chain disruption in 2022 and high inflation in 2023. We are therefore hopeful that a broader set of assets enter and successfully transact in the M&A market in 2025 with validated financials from 2024.

For Baird’s perspectives on the global M&A market in H2 2024, please click here.

Contact a member of our European team to discuss these trends in further detail: