Global Industrial 2024 Mid-Year Update

Strong Momentum Continues for Market-Leading Team

Our Global Industrial team experienced an upward shift in momentum during Q4 of 2023 with a number of high-profile transaction signings. This acceleration continued into the first half of 2024 having signed and closed nearly 40 Industrial transactions YTD. We expect momentum to continue with a record backlog and an active pipeline of high-quality transactions.

As 2H 2024 gets underway, we are keeping a close eye on a handful of themes that will influence the industrial M&A markets in the back half of the year. Our team shares their perspectives below.

What We’re Watching as 2H 2024 Gets Underway

The Waiting Game: Inflation & Fed Policy

As our equity capital markets colleagues highlighted in their recent outlook, the markets will increasingly look to the Fed for clarity on the timing of the first rate cut. Markets are currently pricing in a 100% probability of a September cut. The powerful combination of weaker economic data, signs of disinflation and a cooling labor market add fuel to the desire for certainty.

Labor Availability a Question Mark

The once-white-hot labor market is cooling off. According to the U.S. Bureau of Labor Statistics, job openings totaled 8.1M at the end of May, down 1.2M year-over-year, and the quits totaled 3.5M for the month – down 550K year over year. Put another way, new opportunities have become harder to come by for many workers (particularly white-collar professionals), and fewer workers are voluntarily leaving their roles. Meanwhile, U.S. workforce participation still lags pre-pandemic levels, creating a tough climate for employers hoping to hire talent.

The Broader Impact of AI and Automation

AI and automation continue to reshape the industrial landscape. Significant investments in enhanced infrastructure and additional energy sources are needed to meet expected compute requirements driven by increased data intensity, continued cloud adoption and heightened workload performance requirements. According to information from the U.S. Census Bureau and Baird Research, LTM spending on the construction of data centers was $22.1 billion, up more than 53% year over year and accounts for 3% of overall private nonresidential spending.

All Eyes on the Election

The pending U.S. presidential election presents some headline risk for the M&A market. While deal activity was somewhat subdued in 1H, we’re seeing increasingly constructive fundamentals for deal activity and expect a continued ramp-up in announcements during 2H. The M&A market may become crowded by some processes targeting completion ahead of the election.

That said, looking at M&A activity during the last four presidential years, pending elections had no discernible effects on aggregate M&A activity in 2012 and 2016, though data was impacted by large shocks in 2008 (GFC) and 2020 (COVID).

Energy Transition Humming Along

The macro trend toward sustainability will play an intermediate-term role in driving the broader energy transition. Current U.S. policy is supporting the transition. Two examples include the Inflation Reduction Act, which offers extensive benefits for clean energy, and the Department of Energy has approved up to $7B in funding for the construction and commissioning of seven clean hydrogen hubs across the country. In addition to sustainability, investments in data centers, AI / cloud computing and EV adoption are straining available electricity capacity and additional sources are needed to meet the required demand.

Supply Chain Risks Linger

While some supply chain challenges remain, other new, notable matters have emerged. Of note, widespread detours in the Red Sea have disrupted well-traveled shipping lanes and will have wide-reaching effects on global shipping and supply chains. Another area to watch is the materials supply chain. The high concentration of key materials in a handful of countries meaningfully increases the risks related to natural disaster, international tariffs, war and domestic policy headwinds. Recent onshoring trends are accelerating the buildout of U.S. domestic infrastructure for the procurement and processing of materials. This comes as the rise of EVs is increasing the need for materials such as lithium, cobalt and more. According to data from the International Energy Agency and Baird, EVs require more than 6x critical materials than an internal combustion engine car.

1H 2024 Key Baird Highlights

M&A Transaction Value

$15B+

Baird Multiple Premium vs Broader Industrial Market

3.0X+

PE vs Strategic Buyers

62% PE

38% Strategic

US vs International Buyers

71% US

29% International

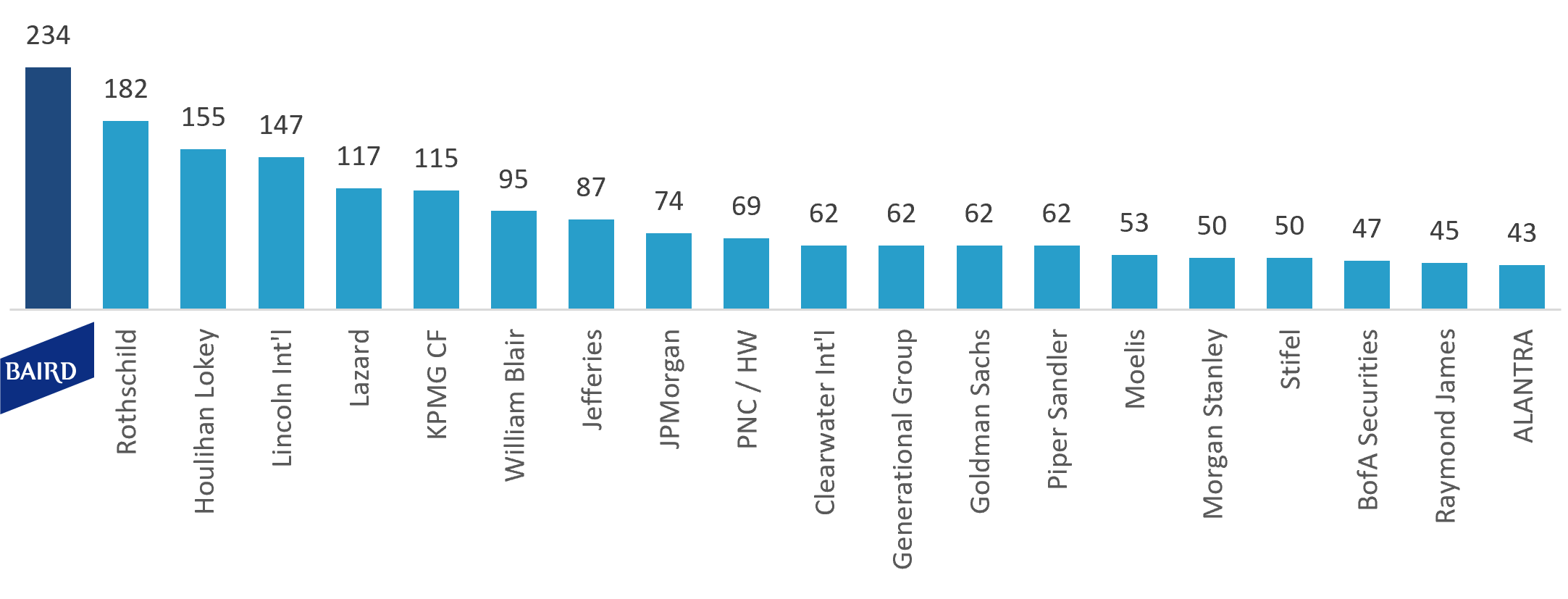

Market Leader in Industrial Sellside M&A(1)

Select 2024 Baird Industrial Transactions

Baird's recent transaction activity creates a positive outlook for the remainder of 2024 and start of 2025. Reach out to our industry-leading team to discuss these transactions and activity in your coverage area.

Related Links

(1)Dealogic US & EU Industrial sell side transactions from January 1, 2017 to June 30, 2024 with total consideration from $100 million – $1.5 billion. Excludes fairness opinions. Includes Dealogic General Industry Group AERO, AUTO, CHEM, CBLG, DEFE, FRES, MACH, AGRI and Specific Industry Group TRAF, TRAL, TREQ, TRFR, UTWM, UTWS.